Welcome to the realm of securing your future with Foresters Final Expense coverage! In life’s journey, ensuring your loved ones are shielded from financial burdens is a heartfelt priority. Imagine a plan that goes beyond mere insurance, a safety net tailored to embrace your family when they need it most.

Foresters’ Final Expense coverage isn’t just about numbers on a policy; it’s a promise; a promise to ease the weight of final expenses and empower your loved ones during a difficult time. It’s a simple yet profound gesture of care, designed with affordable options, a streamlined process, and lifelong coverage. It offers the peace of mind knowing that your legacy includes safeguarding your family’s financial well-being effortlessly.

Let’s embark on an enlightening journey through the features, benefits, and distinctive qualities of Foresters Final Expense, discovering how it stands out as a beacon of reassurance and support in the realm of financial planning.

Understanding Foresters Final Expense Coverage

Understanding Foresters Final Expense coverage is paramount for individuals seeking comprehensive financial security for their loved ones’ futures. This specialized insurance plan serves as a protective shield, specifically designed to alleviate the financial burden associated with end-of-life expenses.

At its core, Foresters Final Expense coverage steps in to cover various costs that arise after an individual passes away. These expenses often include funeral arrangements, outstanding debts, medical bills, and other related costs that can add up quickly and burden grieving families.

The essence of this coverage lies in its simplicity and purposefulness. It aims to offer peace of mind by ensuring that beneficiaries receive the necessary funds promptly, allowing them to focus on honoring their loved one’s legacy without the added worry of financial strain. Unlike many insurance plans, Foresters Final Expense coverage typically features accessible options, minimal underwriting, and lifelong coverage, making it an attractive and practical choice for those planning ahead.

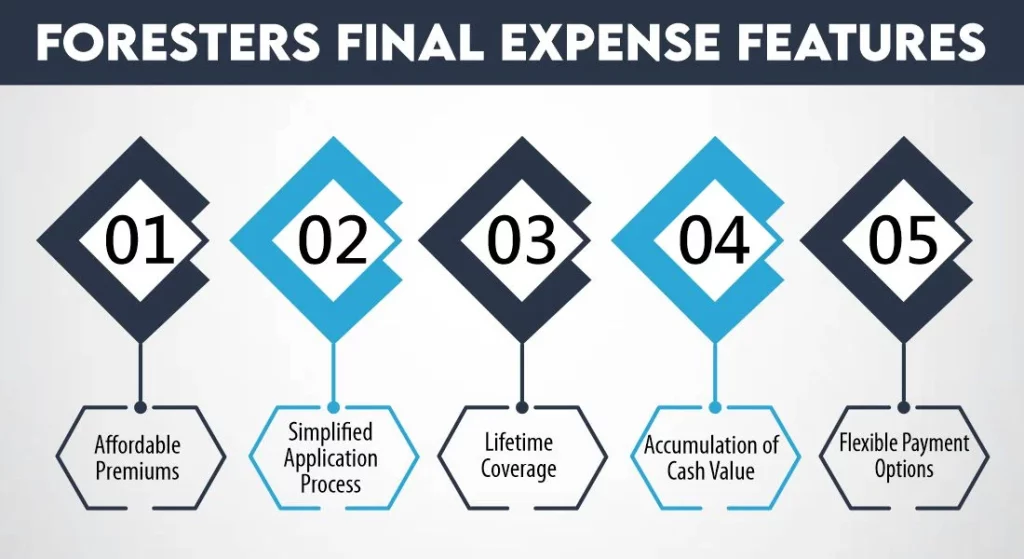

Foresters Final Expense Features

Foresters Final Expense coverage boasts a range of features crafted to cater to the diverse needs of individuals planning for their future. Here’s a closer look at the standout features that make this insurance plan a compelling choice:

1- Affordable Premiums

This plan offers flexibility in premium payments, allowing individuals to choose an affordable option that aligns with their budgetary constraints.

2- Simplified Application Process

Foresters Final Expense streamlines the application procedure, often requiring minimal underwriting. This makes it accessible to a broader range of individuals, including those with varying health conditions.

3- Lifetime Coverage

Once approved, the policy provides coverage for the duration of the insured individual’s life, ensuring beneficiaries receive the benefits when needed, irrespective of age.

4- Accumulation of Cash Value

Over time, the policy accumulates cash value, offering the opportunity to access or borrow against this value when financial needs arise.

5- Flexible Payment Options

Policyholders can select between single or flexible premium payment options, allowing customization based on their financial circumstances and preferences.

How Much Does Life Isurance Cost?

These features collectively make Foresters Final Expense coverage a practical, adaptable, and accommodating choice for individuals seeking reliable financial protection for their loved ones’ future needs.

Foresters Final Expense Plan

The Foresters Final Expense plan is a specialized insurance solution meticulously designed to alleviate the financial burden that often accompanies end-of-life expenses. Tailored with care and foresight, this plan serves as a reliable safety net for individuals and their families during a challenging time.

This comprehensive plan offers coverage that encompasses various expenses incurred after an individual’s passing, including:

- Funeral Expenses: Covering costs associated with funeral services, caskets, cremation, memorial ceremonies, and related arrangements.

- Medical Bills: Assisting in settling outstanding medical bills and healthcare expenses accumulated before the insured individual’s passing.

- Debts and Financial Obligations: Providing support to settle outstanding debts, loans, or other financial obligations, easing the burden on surviving family members.

- Other End-of-Life Costs: Offering financial assistance for miscellaneous expenses that might arise, ensuring a smooth transition for loved ones without added financial stress.

This plan not only addresses immediate financial needs but also allows policyholders to customize their coverage to suit their preferences and budgetary constraints. With its emphasis on simplicity, accessibility, and lifelong coverage, Foresters Final Expense plan stands as a beacon of financial security, offering reassurance to individuals looking to protect their family’s future well-being.

Benefits of Foresters Final Expense

Foresters Final Expense comes with an array of benefits tailored to offer peace of mind and financial security to policyholders and their beneficiaries. Here are the key benefits of opting for Foresters Final Expense:

Financial Security for Loved Ones

The primary benefit is providing a safety net for loved ones, ensuring they are not burdened with the significant costs associated with final arrangements.

Peace of Mind

Knowing that final expenses are taken care of can provide a profound sense of relief and peace of mind for both the policyholder and their family members.

No Medical Exam Requirement

Unlike many insurance plans, Foresters Final Expense often does not mandate a medical examination. This accessibility makes it available to individuals with varying health conditions.

Prompt Payouts

Beneficiaries receive the policy benefits promptly upon the insured’s passing, enabling them to cover expenses without delays during an already challenging time.

Flexible Use of Funds

The funds received from the policy can be utilized according to the beneficiaries’ needs, offering flexibility in handling various expenses related to the insured’s passing.

Lifetime Coverage

With the assurance of lifelong coverage, the plan guarantees that beneficiaries will receive benefits regardless of the age at which the insured individual passes away.

What Makes Foresters’ Final Expense Stand Out?

Foresters Final Expense stands out among insurance options due to several key distinguishing factors:

1- Holistic Member Benefits

Beyond being an insurance plan, Foresters Final Expense offers membership to Foresters Financial, unlocking access to various benefits. These benefits may include scholarships, community grants, and competitive interest-free loans, fostering a sense of community and support.

2- Legacy Planning Services

Foresters emphasizes legacy planning, providing guidance on passing down wealth and values to future generations. This service goes beyond financial coverage, focusing on long-term family prosperity and values.

3- Community Commitment

Foresters demonstrates a strong commitment to social responsibility and community involvement. The company actively contributes to charitable initiatives and community programs, aligning its values with supporting the broader society.

4- Accessibility and Simplified Process

Its accessible nature, with minimal underwriting and simplified application procedures, sets it apart from more stringent insurance plans. This accessibility allows a wider range of individuals, including those with health concerns, to obtain coverage.

5- Lifetime Coverage and Financial Security

The plan’s provision of lifelong coverage and the assurance of financial security for beneficiaries irrespective of age or health condition is a significant standout factor.

These standout qualities collectively make Foresters Final Expense not just an insurance policy but a comprehensive solution that aligns with individuals’ values, community spirit, and long-term financial planning goals.

Conclusion

Foresters Final Expense coverage is more than just an insurance plan; it’s a thoughtful and comprehensive solution designed to provide financial security during a challenging time. Its affordable premiums, simplified application process, and lifetime coverage make it an attractive option for individuals seeking to ease the burden of final expenses on their loved ones.

Additionally, its standout qualities such as member benefits, legacy planning services, and community commitment showcase Foresters’ holistic approach to supporting families beyond insurance coverage. Consider exploring Foresters Final Expense to secure your family’s financial future while ensuring peace of mind for yourself and your loved ones.

FAQs about Foresters Final Expense Coverage

1- Can I purchase Foresters Final Expense coverage for someone else, like a family member or a friend?

Absolutely, you can apply for Foresters Final Expense coverage for someone else, such as a family member or friend, given you have their consent and insurable interest.

2- How quickly are benefits paid out after the insured individual’s passing?

Foresters Final Expense aims to ensure prompt payout of benefits to beneficiaries. Typically, the process involves the submission of required documents, after which benefits are processed efficiently, often within days or weeks after the claim is filed.

3- Are there limitations on how beneficiaries can use the funds received from Foresters Final Expense?

No, there are generally no restrictions on how beneficiaries utilize the funds received from the policy. They can use the money as needed, whether it’s for funeral expenses, outstanding bills, or other financial obligations.

4- Is there a waiting period before the coverage becomes effective?

Foresters Final Expense often provides immediate coverage after approval. However, it’s advisable to review the policy details regarding any specific waiting periods or conditions.

5- Can I make changes to my policy after it’s been issued?

Policyholders may have the flexibility to make changes to their policy, such as adjusting coverage amounts or payment options. It’s recommended to check with the insurer for specifics on policy amendments.

6- Are there additional benefits or features that come with the Foresters Final Expense plan?

Apart from the core benefits, Foresters Final Expense may offer additional features like accidental death coverage or access to other financial planning services. It’s advisable to explore the policy details to understand the full spectrum of benefits available.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.