In the vast journey of life, planning for the unforeseen is an integral part, especially when facing the complexities of health conditions like dementia. For seniors and their families, securing a safety net through life insurance becomes not just a financial decision but a profound step towards ensuring stability amidst uncertainty.

Delving into the world of life insurance tailored for individuals battling dementia is like navigating a maze of options, each with its own set of benefits and considerations. From questions about payout possibilities to understanding the types of coverage available, it’s a realm where clarity and reassurance are paramount.

In this guide, we’ll unravel the intricacies of life insurance for seniors dealing with dementia, shedding light on the benefits, costs, qualifications, and the application process, ultimately empowering you to make informed decisions for the future.

Does life insurance pay out for dementia?

Life insurance can pay out for dementia-related cases, but the coverage largely depends on the specific terms outlined in the policy. In most instances, life insurance policies do cover dementia-related deaths. However, there might be certain conditions or clauses within the policy that affect payout eligibility.

Some policies have exclusions or waiting periods concerning pre-existing conditions like dementia. It’s crucial to carefully review the policy details and terms before purchasing to understand the extent of coverage. Additionally, the specifics of the policy, such as the type of coverage and when the policy was obtained, can impact the payout eligibility for dementia-related cases.

However, life insurance typically covers dementia-related deaths, the policy’s fine print, including waiting periods or specific conditions, can influence the payout process. Therefore, individuals seeking coverage for dementia should thoroughly examine policy details and potentially consult with insurance experts to ensure comprehensive understanding and appropriate coverage.

Life Insurance for Seniors with Dementia

Life insurance for seniors facing dementia can be a critical financial decision, offering a safety net for loved ones and ensuring peace of mind amidst challenging times. However, securing traditional life insurance might pose challenges due to the health condition. For seniors with dementia, specialized options like guaranteed issue life insurance stand as viable solutions.

These policies are designed to cater to individuals with pre-existing conditions, providing coverage without stringent medical exams or detailed health questionnaires. While they may entail higher premiums or lower coverage amounts compared to standard policies, they offer accessibility and acceptance, irrespective of health conditions.

What Types of Coverage are Available for Dementia Patients?

Guaranteed Issue Life Insurance

Guaranteed issue life insurance stands out as a viable coverage option specifically designed for dementia patients and individuals with pre-existing health conditions. This type of policy offers a simplified application process by eliminating the need for medical exams or in-depth health questionnaires.

Key features of guaranteed issue life insurance include:

- Accessibility: These policies are accessible to individuals regardless of their health conditions, including dementia. There are no health-related barriers or requirements, making them a practical option for those who may have difficulty qualifying for traditional life insurance due to their medical history.

- Simplified Underwriting: Guaranteed issue policies do not involve extensive underwriting processes that typically assess an applicant’s health status. This aspect streamlines the application, making it quicker and more straightforward, ensuring approval for those with health challenges like dementia.

- Guaranteed Acceptance: The most significant advantage is the assurance of acceptance. Applicants cannot be denied coverage based on their health condition or medical history, providing a safety net for individuals coping with dementia.

While guaranteed issue life insurance offers accessibility, it’s essential to note that these policies might have higher premiums or lower coverage amounts compared to standard life insurance due to the increased risk for the insurer. However, for those with dementia seeking financial security for their loved ones, these policies serve as a valuable option to consider.

Benefits of Guaranteed Issue Life Insurance for Seniors with Dementia

Guaranteed issue life insurance holds several significant benefits tailored specifically for seniors coping with dementia:

Accessibility

Guaranteed issue life insurance offers coverage without requiring extensive medical underwriting. For seniors dealing with dementia, this accessibility is crucial as it ensures they can obtain life insurance without facing hurdles related to their health condition. It provides an avenue to secure coverage where traditional policies might pose challenges due to health concerns.

How Much Does Life Isurance Cost?

Peace of Mind

These policies offer a profound sense of peace of mind. Seniors diagnosed with dementia and their families often face uncertainty about the future. With guaranteed issue life insurance, there’s reassurance that coverage is secured regardless of the health condition. This peace of mind extends beyond the individual, providing comfort to their loved ones.

Death Benefit

The primary purpose of any life insurance policy is to provide a death benefit. For seniors coping with dementia, this benefit ensures financial support for their beneficiaries upon their passing. These funds can be utilized to cover various expenses, including funeral costs, outstanding debts, medical bills, or other financial burdens. It serves as a crucial support system for families during a difficult time.

What is the cost of life insurance with dementia?

Providing specific facts and figures for cost of life insurance with dementia is not possible due to the variability in insurance rates. However, here is a table demonstrating how the cost of life insurance, especially guaranteed issue policies for seniors with dementia that might fluctuate based on age and coverage amount:

| Age of Insured | Coverage Amount | Monthly Premium (Estimated) |

|---|---|---|

| 65 | $10,000 | $50 – $100 |

| 70 | $15,000 | $75 – $150 |

| 75 | $20,000 | $100 – $200 |

| 80 | $25,000 | $150 – $250 |

Remember that the actual cost of life insurance for seniors with dementia can vary significantly based on factors such as the insurance company, the insured individual’s health condition, location, lifestyle, and specific policy features.

Furthermore, the premiums for guaranteed issue policies tend to be higher than traditional policies due to the higher risk associated with insuring individuals with pre-existing conditions like dementia. Consulting with insurance providers or agents specializing in guaranteed issue policies can provide more accurate and personalized cost estimates tailored to individual circumstances.

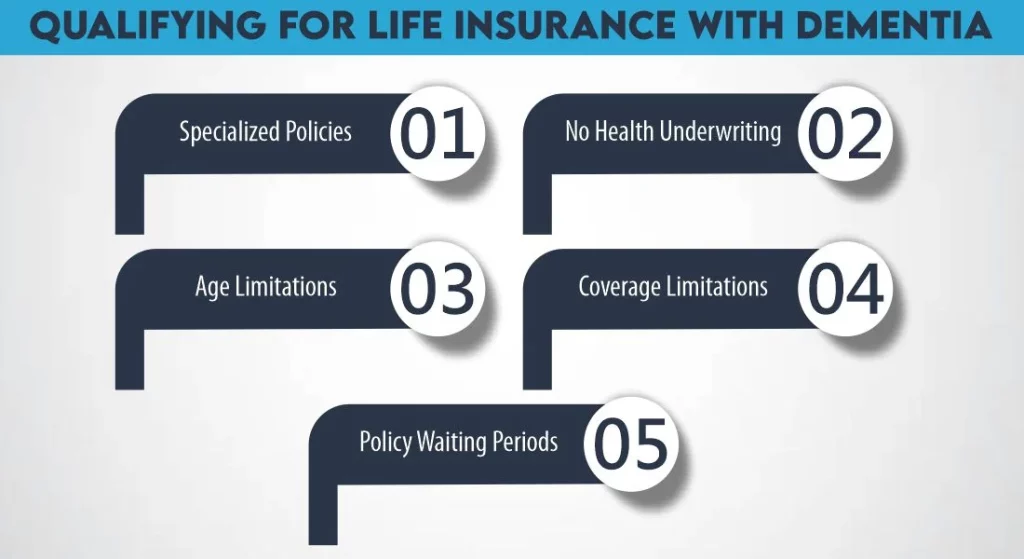

Qualifying for Life Insurance with Dementia

Qualifying for life insurance when dealing with dementia, especially for seniors, often involves specific considerations due to the health condition. Here are essential factors to consider regarding qualification:

1- Specialized Policies

For individuals with dementia, specialized life insurance policies like guaranteed issue plans become a viable option. These policies typically do not require medical exams or detailed health assessments, making them accessible to those with pre-existing conditions.

2- No Health Underwriting

Unlike traditional life insurance policies that involve extensive health evaluations, guaranteed issue policies do not base eligibility on health conditions. This simplifies the qualification process, ensuring acceptance regardless of the individual’s health status, including dementia.

3- Age Limitations

Most insurers offering guaranteed issue policies may have age restrictions, typically catering to seniors within a certain age bracket, often ranging from 50 to 85 years old. Seniors diagnosed with dementia should consider policies available within their age range.

4- Coverage Limitations

Guaranteed issue policies might have limitations on coverage amounts compared to traditional life insurance. Understanding these limitations and assessing whether the coverage meets the needs of the individual and their beneficiaries is crucial when considering such policies.

5- Policy Waiting Periods

Some guaranteed issue policies may include a waiting period before the full death benefit becomes payable. It’s essential to understand these waiting periods, as they can impact when the policyholder’s beneficiaries will receive the full coverage amount.

How prescriptions for Dementia affect life insurance qualification?

Prescriptions for dementia can influence the qualification process for life insurance, especially when applying for traditional policies that involve medical underwriting. Insurers often assess an applicant’s overall health, including prescribed medications, to evaluate the risk associated with insuring them. However, guaranteed issue policies typically do not focus on specific medications or health details, simplifying the qualification process.

How to Apply for Life Insurance with Dementia?

Applying for life insurance when dealing with dementia, especially for seniors, involves a strategic approach to navigate the process effectively. Here’s a step-by-step guide on how to apply for life insurance in such circumstances:

- Research Specialized Policies: Explore insurers offering guaranteed issue or tailored policies for dementia patients.

- Gather Information: Collect personal and medical details required for the application.

- Consult Experts: Seek guidance from insurance specialists familiar with policies for dementia cases.

- Complete Application: Fill out the application accurately and honestly, including dementia diagnosis and medication details.

- Review Policy Terms: Carefully examine coverage, premiums, waiting periods, and specific clauses related to dementia.

- Submit Application: Send the completed application along with necessary documents to the insurer.

- Follow-Up: Check with the insurer for application status and provide additional information if needed.

- Review Issued Policy: Ensure the policy aligns with discussed terms and understand coverage limitations.

Following these concise steps can help simplify the process of applying for life insurance despite dealing with dementia.

The Bottom Line

Life insurance for seniors with dementia is a crucial step in securing financial stability for loved ones. While traditional policies might pose challenges due to health conditions, guaranteed issue life insurance serves as a viable option. Understanding available coverage, costs, qualifications, and the application process empowers families to make informed decisions to protect their future.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.