Overpayment of medicare part b premium: Refund Process Guide

Are you unknowingly overpaying for your Medicare Part B premium? It’s not a common question. But could it be possible that you’re overpaying your Medicare Part B premium without even realizing it?

In this guide, in the first step, let’s uncover whether you’ve been paying more than necessary for your Medicare Part B coverage. Let’s tackle this together: how to cover the Overpayment of medicare part b premium and how to refund this Overpayment?

Understanding Medicare Part B Overpayments

Understanding Medicare Part B overpayments is crucial for healthcare providers and suppliers to maintain compliance with federal regulations. An overpayment of medicare part b premium occurs when payments received from Medicare exceed the amounts due under applicable billing and coding regulations, often due to billing errors, incorrect coding, or the provision of services not deemed medically necessary.

The legal framework, notably the False Claims Act and the Affordable Care Act mandates providers to diligently identify and return overpayments within a 60-day window to avoid severe penalties. This necessitates a proactive approach to auditing, monitoring, and educating staff on billing practices. Addressing overpayments promptly and effectively aligns with legal obligations and underscores a commitment to ethical healthcare delivery and the stewardship of public funds.

Legal Obligations and Timelines

The legal obligations and timelines surrounding overpayment of medicare part b premium ensure that healthcare providers and suppliers act promptly and responsibly upon identifying any excess payments received. These regulations are enforced under the False Claims Act (FCA) and further detailed within the Affordable Care Act (ACA) provisions. Understanding these requirements is crucial for maintaining compliance and avoiding potential legal repercussions.

Legal Obligations

Immediate Identification and Correction: Healthcare providers must actively identify and correct overpayments. This responsibility is not passive; it requires diligent oversight of billing practices to ensure accuracy and compliance with Medicare rules.

Reporting and Returning Overpayments: The provider must report and return the overpayment to Medicare upon identifying an overpayment. This process involves not just reimbursing funds but also providing a detailed explanation of the overpayment’s cause and outlining measures taken to prevent similar issues.

Compliance with the False Claims Act: The FCA imposes liability on individuals and companies who defraud governmental programs, including Medicare. Retention of overpayments beyond the specified timelines can be construed as a violation of the FCA, leading to substantial penalties.

Timelines

The timelines for addressing Medicare Part B overpayments are strictly defined:

60-Day Rule: The ACA specifies that providers must report and return overpayments within 60 days of identification or by the date any corresponding cost report is due, if applicable. The identification of an overpayment is said to occur when a provider has or should have determined that an overpayment was received and quantified the amount through the exercise of reasonable diligence.

How Much Does Life Isurance Cost?

Reasonable Diligence: The concept of reasonable diligence implies that providers should have proactive compliance programs to detect overpayments. The Centers for Medicare & Medicaid Services (CMS) suggests that a period of up to six months to conduct an investigation (from obtaining credible information to concluding the inquiry) generally meets the reasonable diligence standard, though circumstances could vary.

Identifying Overpayments For Healthcare Providers:

Healthcare providers can identify overpayment of medicare part b premium by meticulously reviewing the remittance advice that accompanies payments from Medicare. These documents are akin to the MSNs received by beneficiaries but are tailored for providers, detailing services billed, amounts reimbursed by Medicare, and any discrepancies or adjustments. Providers should:

Review Each Payment Notice:

Check each remittance advice for accuracy, focusing on the payment amounts, service codes, and patient information to ensure they match the services provided.

Understand the Codes: Familiarize yourself with the adjustment and denial codes used by Medicare. These codes can indicate why a payment was reduced, or an overpayment might have occurred.

Audit Regularly:

Conduct regular audits of billing records and compare them against remittance advice to identify discrepancies that may indicate overpayments.

Implement a Compliance Program:

A comprehensive compliance program can help in early detection and resolution of overpayments, reducing the risk of legal repercussions.

For Medicare Beneficiaries

Beneficiaries receive MSNs every three months for services covered by Medicare. These notices provide detailed information about claims for Medicare-covered services or supplies billed to Medicare. To recognize overpayments:

Review Your MSN: Regularly check your overpayment of medicare part b premium Summary Notices for any services you did not receive, duplicate charges, or services your healthcare provider did not order.

Understand Services and Charges: Be aware of the services you received and their expected costs. If you notice services you did not receive or those billed at higher rates, it may indicate an overpayment.

Keep Records: Keep healthcare receipts and documents organized. Having a personal record of the services you received will make it easier to spot discrepancies in your MSN.

Recognizing When You’ve Paid Too Much:

Action Steps if Overpayments are Identified:

Contact Your Provider: If you suspect an overpayment, contact the healthcare provider or the billing department to discuss the discrepancy. Often, errors can be resolved directly with the provider.

Report to Medicare: If the issue is unresolved or you suspect fraud, report the discrepancy to Medicare. Providers should follow the appropriate Medicare procedure for reporting and returning overpayments.

Documentation: Keep a record of all communications regarding the overpayment, including who you spoke with and the conversation’s outcome. This documentation can be crucial if the issue escalates.

How do I get a refund from Medicare Part B overpayment?

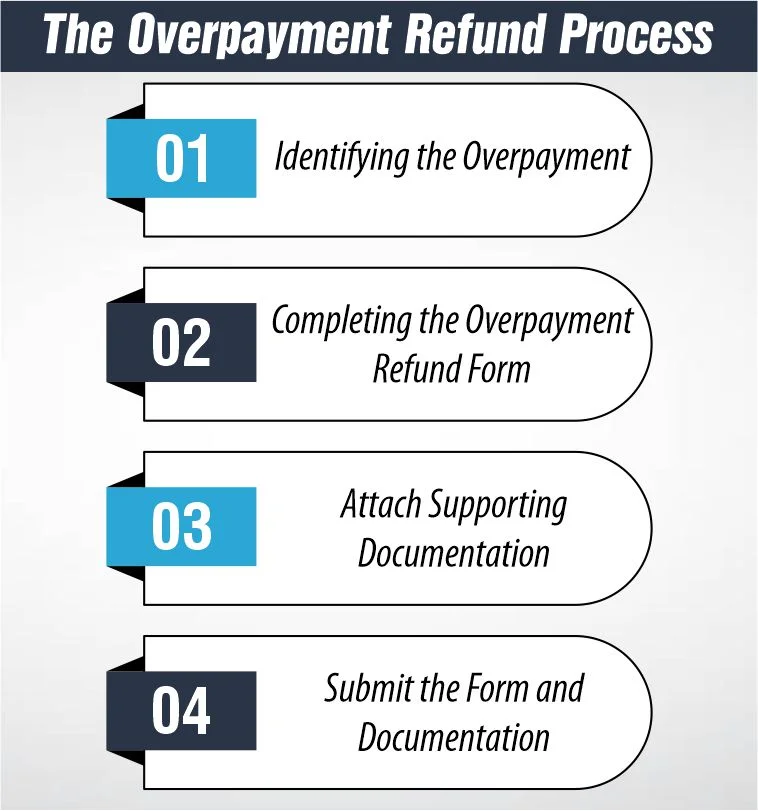

The medicare part b premium overpayment refund process is a systematic method for healthcare providers and beneficiaries to return funds mistakenly paid out by Medicare or insurance companies. This process begins with the medicare part b overpayment refund form and may involve responding to a Demand Letter. Here’s a concise guide through these steps:

Identifying the Overpayment

Before initiating the refund process, identify the overpayment by reviewing Medicare Summary Notices (MSNs), Explanation of Benefits (EOBs), or provider payment notices. Confirm the overpayment by cross-referencing services provided, payment received, and the terms of the insurance coverage.

Completing the Overpayment Refund Form

Then, obtain and fill out the medicare part b overpayment refund form, which is essential for initiating the refund process. This form typically requires:

Personal or Provider Information: Name, address, and contact details, along with any relevant identification numbers (e.g., Medicare ID).

Patient Details: Patient’s name and insurance ID, including the dates of the services in question.

Overpayment Information: Amount of overpayment, claim numbers, and detailed reasons for the refund, such as billing errors or services not received.

Attach Supporting Documentation

Attach all relevant documentation to support your refund claim. This includes billing statements, remittance advice indicating the overpayment, and other pertinent communication.

Submit the Form and Documentation

Review your submission for completeness and accuracy, then send it to the specified address, usually found on the form or the payer’s website. Retain a copy of your submission for your records.

Overpayment Collection Tools

Demand Letter

A MAC demand letter explains:

- Overpayment reason(s)

- Interest accrual begins if the overpayment is not repaid in full within 30 days

- Immediate recoupment request options

- Extended Repayment Schedule (ERS) request options

- Rebuttal rights

- Appeal rights

Choose from these options when responding to an initial demand letter:

- Make an immediate payment

- Request immediate recoupment

- Submit a rebuttal

- Appeal the overpayment by requesting a redetermination

Overpayment collection process:

Here’s a detailed guide on navigating this process, managing issues related to the self-referral law, and what to expect after submitting your refund request.

Submitting a Voluntary Refund

Identifying the Overpayment: The first step involves identifying the overpayment through a thorough review of billing records, payment notices, and patient accounts.

Completing the Necessary Forms: Obtain the appropriate medicare overpayment form part b from the Medicare contractor or insurance provider’s website. Fill out the form with the following details:

- Provider’s or beneficiary’s contact information

- Patient information, including Medicare or insurance ID

- Details of the overpayment, including the amount, the claim number(s), and a detailed explanation of why the payment was incorrect

Attaching Supporting Documentation: Attach all relevant documentation to your refund request. This includes copies of the original billing statements, payment notices, and any correspondence related to the discrepancy.

Submitting the Refund: Review all the information for accuracy and completeness, then submit the medicare overpayment form part b and accompanying documentation to the address provided by the Medicare contractor or insurance company. It’s advisable to send this package via a traceable mail service.

Navigating the Self-Referral Disclosure Protocol

The Self-Referral Disclosure Protocol (SRDP) is specifically designed to disclose potential self-referral law violations (Stark Law). If the overpayment is related to a self-referral violation, the process differs slightly:

Preparing the Disclosure: The SRDP requires a comprehensive disclosure, including detailed information about the potential violation, the financial impact, and the steps taken to prevent future violations.

Submitting the Disclosure: The disclosure should be submitted to the Centers for Medicare & Medicaid Services (CMS) through the specific channels established for SRDP submissions.

Await CMS Response: After submission, CMS will review the disclosure and may contact the provider for additional information or negotiation regarding the repayment.

After Submitting Your Refund Request

Acknowledgment of Receipt: Expect to receive an acknowledgment of receipt from the payer. This typically happens within a few weeks of submission.

Review and Decision: The Medicare contractor or insurance provider will review your submission. This process can take several months, depending on the complexity of the overpayment situation.

Follow-Up: If you do not receive acknowledgment or a decision within the expected timeframe, follow up with the contractor or provider. Keep detailed records of all communications.

Repayment or Adjustment: You will be notified of the decision once the review is complete. If the refund is accepted, the overpaid amount may be returned to you, or your account will be adjusted. In some cases, you may be asked to provide additional information.

Documentation: Keep all correspondence and documentation related to the refund submission. This documentation is crucial for your records and may be needed for future reference.

Avoiding Future Overpayments: Tips and Preventative Measures

Avoiding future overpayment of medicare part b premium is pivotal for healthcare providers and Medicare beneficiaries to ensure compliance and maintain financial accuracy. Overpayments cause unnecessary administrative work, can lead to penalties, and affect trust in healthcare billing practices. Here are essential tips and best practices to minimize the risk of future overpayments.

For Healthcare Providers

- Regular Training on Billing and Coding: Continuous education on the latest billing and coding practices is essential. Ensure your staff is up-to-date with current Medicare policies, coding updates, and billing procedures to prevent errors that could lead to overpayments.

- Implement Advanced Billing Systems: Use sophisticated billing software that incorporates error-checking features. These systems can automatically flag common errors or discrepancies before claims are submitted, reducing the risk of overpayments.

- Conduct Regular Billing Audits: Periodic internal and external audits of billing practices help identify and rectify mistakes early. Audits can uncover patterns that may lead to overpayments and provide insights into areas needing improvement.

- Stay Informed About Medicare Policies: Medicare policies and guidelines are subject to change. Staying informed about these changes helps ensure billing practices comply with current regulations, reducing the likelihood of overpayments.

- Encourage a Culture of Accuracy and Transparency: Promote an organizational culture prioritizing billing and coding accuracy. Encourage staff to report potential billing errors without fear of repercussions.

- Utilize Claim Scrubbing Services: Before submitting claims, consider using claim scrubbing services that can review and verify the accuracy of claims, highlighting potential errors or inconsistencies.

For Medicare Beneficiaries

Review Medicare Summary

Notices (MSNs) and Explanations of Benefits (EOBs): Regularly review your MSNs and EOBs for any charges for services you did not receive or for services billed incorrectly. This can be a first line of defense against overpayments.

Understand Your Medicare Coverage:

Familiarize yourself with the details of your Medicare coverage. Knowing what is covered and what is not can help you identify potential billing errors or overcharges.

Keep Detailed Healthcare Records:

Maintain a personal record of the dates and types of healthcare services you receive. These records can be invaluable when verifying the accuracy of billed services.

Report Suspected Errors Promptly:

If you suspect a billing error or overpayment, report it immediately to the healthcare provider or your Medicare plan. Prompt action can prevent further complications.

What to do? if Overpayments Aren’t Returned:

When overpayment of medicare part b premium occurs by mistake, giving back the extra cash is important. If this money isn’t returned, there could be big problems. First, the amount you owe could increase because of extra interest charges. Medicare might also take steps to get their money back, like taking it out of future payments or even taking legal action, which could get serious.

For doctors and health centers, not returning the money could mean they’re not allowed to work with Medicare anymore, which would be a big deal because they wouldn’t be able to see Medicare patients. And for people who use Medicare, not fixing overpayments could hurt their credit score, making it harder to borrow money in the future. That’s why it’s super important to ensure everything is correct and fix any payment mistakes immediately.

FAQs

How can I avoid future Medicare Part B overpayments?

To avoid future Medicare Part B overpayments, regularly conduct internal audits of billing practices and stay updated on Medicare’s latest coding guidelines and policy changes. Engaging in continuous staff education on billing procedures also helps minimize errors leading to overpayments.

Is there a deadline for reporting Medicare Part B overpayments?

Yes, there is a deadline for reporting Medicare Part B overpayments. Providers must report and return any identified overpayments to Medicare within 60 days from the date the overpayment was identified, by the Affordable Care Act’s requirements.

References:

https://www.cgsmedicare.com/jb/claims/opay/refunding.html

https://www.cgsmedicare.com/partb/forms/overpayment.html

https://www.palmettogba.com/palmetto/jmb.nsf/DIDC/AKAJFL5514~Overpayments%20and%20Recoupment

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.