In today’s uncertain world, planning for the future is more important than ever. Investing in pre-need insurance is one effective way to ensure peace of mind for you and your loved ones.

Preneed insurance, also known as prepaid funeral insurance or burial insurance, is a type of insurance policy that helps cover the cost of funeral expenses and related services. It allows you to make funeral arrangements in advance and permits your funeral home to cover the burial cost and related services with the help of death benefits.

Want to know more about this special type of insurance? Well! You are at the right place. In this blog post, we’ll explore what pre-need insurance is, how it works, and the benefits it offers. Let’s have a look!

What is Preneed Insurance?

Pre-need insurance, also known as prepaid funeral insurance or burial insurance, is a specialized type of insurance policy that helps cover the costs associated with a funeral and burial. Unlike traditional life insurance policies that provide a lump-sum payment to beneficiaries upon the policyholder’s death, preneed life insurance is specifically designed to cover funeral expenses.

When you purchase a pre-need insurance policy, you work with a funeral home or insurance agent to plan and pay for your funeral services in advance. This can include costs such as the casket, funeral service, burial plot, and other related expenses. The policyholder pays a premium, either in a lump sum or through regular payments, and in return, the policy will pay out a predetermined amount to cover the costs of the funeral services outlined in the policy.

Pre-need insurance can offer peace of mind to both the policyholder and their loved ones, ensuring that funeral expenses are covered and relieving the family of financial burdens during a difficult time.

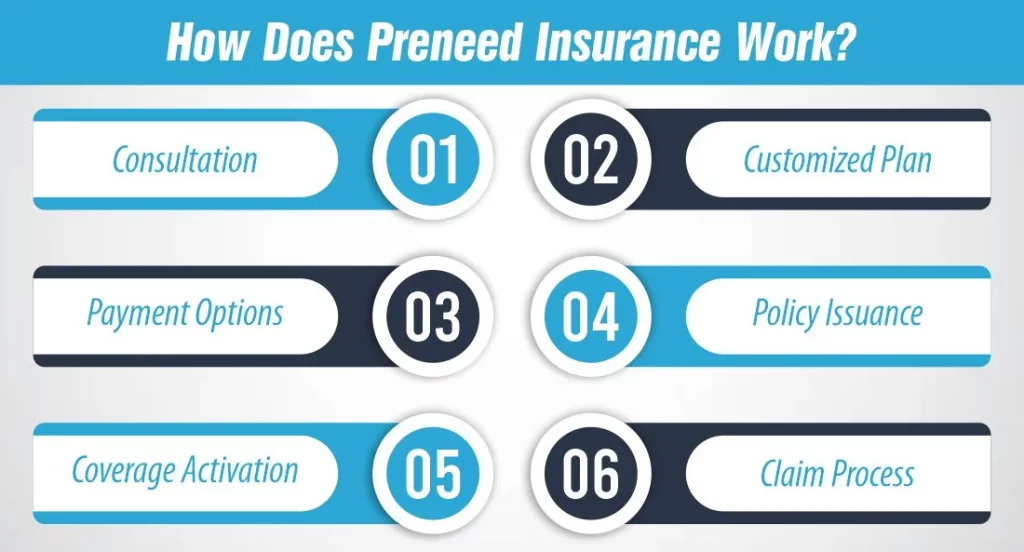

How Does Preneed Insurance Work?

Pre-need insurance works by allowing individuals to prepay for their funeral expenses, ensuring that their final wishes are carried out and relieving their loved ones of the financial burden. Here’s how it typically works:

1- Consultation

The process begins with a consultation between the individual and a funeral home or insurance agent. During this consultation, the individual discusses their final wishes and selects the funeral services they desire.

2- Customized Plan

Based on the consultation, a customized pre-need insurance plan is created. This plan outlines the funeral services chosen by the individual and the total cost.

3- Payment Options

The individual can choose to pay for the preneed life insurance policy in a lump sum or through installment payments. The payment schedule is outlined in the policy agreement.

4- Policy Issuance

Once the payment is made, the pre-need insurance policy is issued to the individual. This policy acts as a contract between the individual and the insurance company, specifying the terms of coverage and the services to be provided.

5- Coverage Activation

The preneed life insurance is activated immediately upon issuance, providing coverage for the specified funeral services.

How Much Does Life Isurance Cost?

6- Claim Process

When the individual passes away, their loved ones can file a claim with the insurance company. Upon approval, the insurance company will pay out the predetermined amount directly to the funeral home to cover the cost of the funeral services.

Overall, pre-need insurance offers a convenient way to plan and pay for funeral expenses in advance, ensuring that the individual’s final wishes are honored and their loved ones are protected from financial stress.

Benefits and Drawbacks of Preneed Insurance

Just like any other insurance plan, preneed comes with its own set of benefits and drawbacks, let’s explore them:

Benefits

- Financial Security: Preneed life insurance provides financial security by covering the cost of funeral expenses, relieving loved ones of this financial burden.

- Price Protection: This insurance locks in the price of funeral services at today’s rates, protecting against inflation and rising costs.

- Customization: It allows individuals to customize their funeral plans according to their wishes and budget, ensuring their final arrangements are carried out as desired.

- Ease of Payment: Preneed insurance offers flexible payment options, including lump-sum or installment payments, making it easier to fit into a budget.

- Peace of Mind: Perhaps the most significant benefit of pre-need insurance is the peace of mind it provides, knowing that one’s funeral expenses are taken care of.

Drawbacks

- Limited Portability: Preneed insurance policies are typically tied to a specific funeral home, limiting the ability to transfer the policy if the individual moves or changes their mind about the chosen funeral home.

- Possible Changes in Services: If the individual’s preferences change over time, there may be limitations or additional costs associated with altering the prearranged funeral services.

- Potential Loss of Investment: If the individual pays for the pre-need insurance policy in full but passes away shortly after, the full value of the policy may not be realized, leading to a potential loss of investment.

- Regulatory Issues: Preneed insurance is regulated at the state level, and regulations can vary significantly from state to state, leading to potential confusion or complications.

Despite these drawbacks, many individuals find that the benefits of preneed life insurance outweigh the potential drawbacks, providing them with peace of mind and financial security in their final arrangements.

What is the Cost of Preneed Insurance?

The cost of preneed life insurance can vary depending on several factors, including the individual’s age, health, location, and the type of funeral services chosen. To provide a general idea of the cost, here is a table showing estimated monthly premiums for pre-need insurance for a non-smoking individual based in the United States:

| Age Range | Coverage Amount | Estimated Monthly Premiums |

| 50-59 | $10,000 | $30 – $50 |

| 60-69 | $10,000 | $50 – $80 |

| 70-79 | $10,000 | $80 – $120 |

| 80+ | $10,000 | $120 – $200 |

Please note that these are rough estimates and actual premiums may vary. It’s advisable to consult with a licensed insurance agent or funeral home to get a personalized quote based on your specific circumstances and preferences.

Who Should Opt for Preneed Life Insurance?

Preneed life insurance is a valuable option for individuals who want to plan for their funeral expenses and ensure that their final wishes are honored. Here are some individuals who may benefit from opting for preneed life insurance:

Seniors

Seniors who are concerned about the financial burden their funeral expenses may place on their loved ones may find preneed life insurance to be a practical solution. By prepaying for their funeral expenses, seniors can provide peace of mind for themselves and their families.

Those with Specific Funeral Wishes

Individuals who have specific preferences for their funeral arrangements, such as the type of service, casket, or burial plot, may opt for preneed life insurance to ensure that their wishes are carried out.

Those with Limited Financial Resources

Preneed life insurance can be a suitable option for individuals with limited financial resources who want to ensure that their funeral expenses are covered without placing a significant financial burden on their families.

Those Seeking to Protect Against Rising Costs

With funeral costs steadily increasing over time, preneed life insurance offers individuals the opportunity to lock in today’s prices and protect against future inflation.

Anyone Looking for Peace of Mind

Ultimately, preneed life insurance is for anyone who wants to take proactive steps to plan for their final arrangements and provide peace of mind for themselves and their loved ones.

It’s essential for individuals considering preneed life insurance to carefully evaluate their options, consult with a licensed insurance agent or funeral home, and thoroughly understand the terms and conditions of the policy before making a decision.

Tips to Get Affordable Preneed Life Insurance

Getting affordable preneed life insurance can help you plan for the future without breaking the bank. Here are some tips to help you find cheap preneed life insurance:

Compare Quotes:

Shop around and compare quotes from multiple insurance providers to find the best rates. Consider working with an independent insurance agent who can provide quotes from various companies.

Choose a Basic Plan:

Opt for a basic preneed life insurance plan that covers essential funeral expenses. Avoid adding unnecessary features or upgrades that can increase the cost of the policy.

Pay Annually:

If possible, pay your preneed life insurance premium annually instead of monthly. Insurance companies often offer discounts for annual payments.

Maintain Good Health:

Insurance premiums are lower for individuals in good health. Maintain a healthy lifestyle and avoid habits like smoking that can increase your premiums.

Consider a Group Plan:

Some employers, organizations, or associations offer group preneed life insurance plans at discounted rates. Check if you are eligible for such a plan.

Start Early:

The younger you are when you purchase preneed life insurance, the lower your premiums are likely to be. Start planning and purchasing coverage early to lock in lower rates.

Review and Update Your Policy:

Regularly review your preneed life insurance policy to ensure it still meets your needs. Adjustments may help you reduce costs if your circumstances change.

Ask About Discounts:

Inquire with insurance providers about any discounts they offer. For example, some insurers offer discounts for paying premiums having multiple policies with the same company.

By following these tips, you can increase your chances of finding affordable preneed life insurance that meets your needs and budget.

Summing Up

Preneed insurance is an excellent option for those looking to plan and ensure that their funeral expenses are covered. By purchasing a preneed life insurance policy, you can provide financial security for your loved ones. protect against rising funeral costs, customize your funeral plan, and enjoy peace of mind knowing that your final wishes will be honored. Consider speaking with a licensed insurance agent or funeral home to learn more about pre-need insurance and how it can benefit you and your family.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.