What Not To Do When Someone Dies: List of Things to Avoid

Losing a loved one is a profoundly emotional experience that can leave you feeling overwhelmed and unsure of what to do next. Amid grief, it’s important to be mindful of the actions you take and the decisions you make. Knowing what not to do when someone dies can help you navigate this challenging time with more clarity and ease.

In this blog post, we’ll explore common pitfalls to avoid when dealing with the death of a loved one. From rushing into decisions to neglecting your own grief, we’ll provide practical tips to help you navigate this difficult time.

By being aware of these pitfalls, you can ensure that you’re honoring your loved one’s memory while also taking care of yourself and your family. Let’s discuss together what not to do and what to do as well when someone dies and how to navigate this sensitive time with grace and compassion.

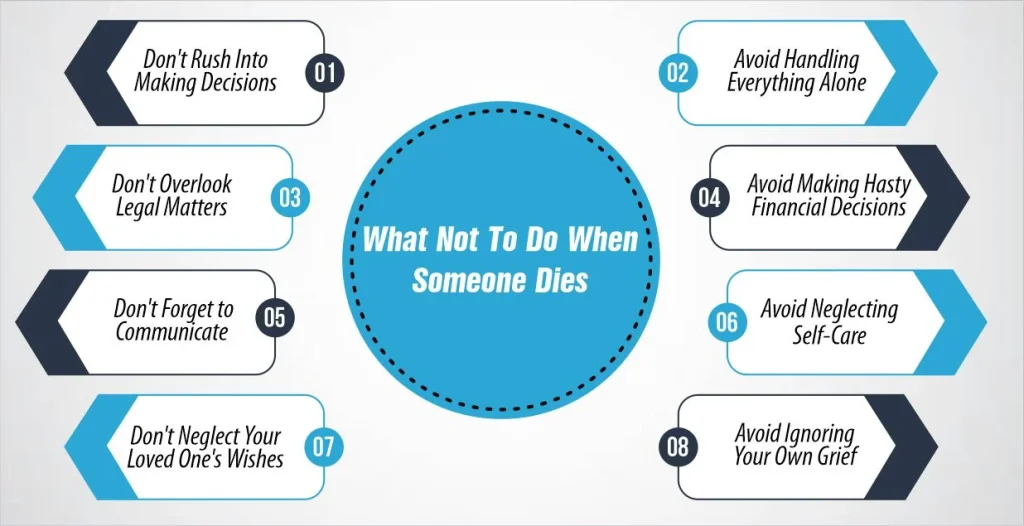

What Not To Do When Someone Dies

What Not To Do When Someone Dies

Death of someone loved is one the most upsetting situations an emotional aspect; on top of that, the formality that is needed afterwards is not easy to handle. It is essential to know what to not do when someone passes away, as you might get into your retraction quickly in the whole grief period.

1- Don’t Rush Into Making Decisions

Immediately after death, however, there promises to be urgency and a need for speedy resolutions of funeral operations, estate issues and financial stuff. However, this doesn’t mean you should hastily jump into life-changing choices such as changing majors or careers. All you have to do first is to give yourself enough time to accept this loss.

2- Avoid Handling Everything Alone

Humans are prone to making mistakes and sometimes the desire to do things yourself alone can be very overwhelming. It is, therefore, essential to seek help when you can’t handle some of the responsibilities. Allocate tasks to a relative or a friend, and only consider the paid service of a funeral director or estate planner for guidance.

3- Don’t Overlook Legal Matters

There are various laws to worry about after one’s death, like getting a death certificate, notifying governmental bodies, and taking care of the estate. It is a mandate to know the legal matters which offers a piece of legal advice and assures that you follow the right procedures as well as obligatory legal matters.

4- Avoid Making Hasty Financial Decisions

Your life after death can be a bit hectic, now you may have advice or offers about money matters. Being watchful over decisions of this kind including the involvement of a financial advisor or estate planner is a smart thing to do. Find out the details about your family member’s financial status and check whether their choice has an impact on their long-term personal finance.

5- Don’t Forget to Communicate

Steering friends and relatives in the right direction on matters about funeral arrangements and updates is central. Skipping communication may provoke difficulties for many people to understand, and also impose stress on the parties in question. So, your communication plan should also be detailed and cover the frequency of message dissemination to keep everyone updated.

6- Avoid Neglecting Self-Care

Mourning is mentally draining at the same time it may affect your physical health. It is essential to take care of yourself and make sure you are not overwhelmed. To do this, be sure to eat right, sleep enough, and find people to talk to for extra backup. Attending a support group or receiving counseling to find ways to deal with the loss could be another possible option for you.

How Much Does Life Isurance Cost?

7- Don’t Neglect Your Loved One’s Wishes

One way of showing respect is if your relative appoint the type of funeral service you will follow or their estate wants something specific, it’s important to honor those wishes to the best of you. Separately, consult any legal document such as a will or advance directive, to make sure you are impartial to their express wishes.

8- Avoid Ignoring Your Own Grief

In all the responsibilities and decision-making that death astonishes, grief tends to be undervalued, especially one’s own. Allow yourself the time to mourn and to get cheer-me-up from your friends. Your grief should not be left undealt with since one day it may result in serious emotional problems and some troubles in the future.

As death is typically a challenging experience for the family, a clear understanding of what to avoid when a death occurs will give you the ease of navigation during this hard time. By eliminating these common traps, you will ensure that you are honoring such a person’s memory and at the same time taking care of yourself and your family.

What to Do When Someone Dies

Looking for the things to do when someone dies? Well! Saying goodbye to someone dear to you is such a hard event. Getting a head-start through knowing what needs to be done next can help you deal with the difficult situation that is death with more peace and clarity.

Here are some important things to consider and do when someone passes away:

Notify Family and Friends

Besides the fact that you need to inform the late person’s close family and friends of the death. This can be accomplished either directly or indirectly using live or online communication platforms like phone, email, text message etc.

Contact a Funeral Home

It is up to the next of kin to contact the nearest funeral home to make arrangements on what will be done with the body if the dead person has not made prior arrangements. A funeral home will be able to walk you through planning the funeral or a memorial service.

Obtain a Death Certificate

A death certificate or a document that certifies the time and cause of the person’s death is necessary and you will need to obtain it. This document will protect the workers from legal and financial repercussions.

Notify Relevant Authorities

It may be necessary to deal with any number of agencies depending on the situation behind the death, for example, the police, coroner, or medical examiner. They will be able to verify whether additional inspections are required or not.

Secure Property and Possessions

If the person was living alone, look after your property and get your possessions so that you should not be a target for thieving or damage, especially at a time of hardship. You can also consider hiring a pet care provider, if necessary.

Notify Employer and Insurance Companies

For the case where the reason for death was related to employment, it is paramount to inform the employer about the death. Additionally, the agent should ensure that the clients’ insurance companies receive the policy cancellation notices and appropriate compensation.

Arrange for Care of Dependents

Take care of the dependents (e.g. children, elderly relatives) by making the necessary arrangements for a caregiver and financial support just in case.

Review Legal and Financial Documents

Firstly, if the person had a will then read it and any other vital legal and financial documents. Lawyers and finance advisors might be the people you should call home if you do not know what to do.

Take Care of Yourself

Grieving is a normal thing you should learn to stand it. Therefore, you ought to be aware of your state and attend to your needs. Search for solace in your closest friends and relatives or talk with a counselor, then let yourself be sad and show your true emotions.

No matter how hard one tries to prepare, the death of a beloved person is always a difficult task. Acknowledging what steps to take can provide some assistance in going through the process better. It’s much better to ask for help than trying too hard and fear of failure. Therefore, let’s proceed step by step.

Don’t Forget to Check out the Life Insurance Policy of the Deceased

After someone dies, one of the vital things that should be done is to see if the deceased person has a life insurance policy. The most significant advantage of life insurance is that upon the departure of the named beneficiaries can be financially supported by covering any expenses that they may have as well as providing for a source of income.

Here’s what you should do to check the life insurance policy of the deceased:

1- Search for Policy Documents

Go through the deceased person’s belongings and check for any life insurance policy certificates. They can both be represented in physical terms such as a policy document, emails, and web accounts.

2- Contact the Employer

Assuming that the victim was a staff member, get in touch with their company to know if they had the group life insurance policy they got from there.

3- Review Bank Statements

Check their bank statements and see if there are any recurring payments to any insurance company as they may have placed a life insurance policy.

4- Contact the Insurance Company

In case you are about to realize that this person used to carry life insurance and cannot come up with any documents related to insurance contact the company’s representatives directly. Indicate to them what information they’ll take, namely – the person’s full name, date of birth and Social Security number if any is available.

5- Check with the State Insurance Department

The insurance company or policy particulars may be missing or difficult to trace, and in case of such an event, you can consult the state insurance department. They may help you in various ways by directing you to locate that policy.

6- Review Online Accounts

Verify if there are any email messages from insurance companies in the deceased’s email account and online accounts or not.

7- Consult with an Attorney

If You have problems getting into the life insurance policy, do not end just yet. You can ask an attorney who specializes in estate matters for clarifications. They can be ready to show you where the policy is being kept, or whether the dead person had other assets in financial terms.

In case of untimely death, one of the most important things to do is to check whether the life insurance policyholder has such. This offer can help the deceased’s beneficiary cover expenses and settle their debts. Searching for the details of the policy ensures that the advantages will be received in a timely way.

Final Verdict

The final verdict is that the demise of our loved ones is a tasking and emotional thing. Making knowledgeable decisions that come from being conscious about what not to do when someone dies (like hurrying with decisions or neglecting yourself), will help you walk the path of losing someone with more clarity and calm. Don’t forget about your memoir but take time to take care of yourself and your family too.

References:

https://www.lantern.co/articles/8-mistakes-to-avoid-after-the-death-of-a-loved-one

https://community.aarp.org/t5/Grief-Loss/Top-10-Things-Not-to-Do-When-Someone-Dies/m-p/2488907

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

What Not To Do When Someone Dies

What Not To Do When Someone Dies