Borrowing against Unum Life Insurance Policy: Complete Guide

Life insurance serves as a crucial financial safety net, offering peace of mind knowing your loved ones are protected financially. Unum, a trusted insurance provider, offers policies that not only safeguard your family’s future but also provide a unique financial opportunity.

One such feature is the ability to borrow against the cash value of your Unum life insurance policy. This option allows you to access funds for various needs without undergoing a credit check or providing collateral. However, like any financial decision, there are important considerations and potential consequences to understand before proceeding.

In this article, we’ll explore the details of borrowing against your Unum life insurance policy, including how it works, its benefits, drawbacks, and what you should consider before taking this step. Understanding these aspects will help you make an informed decision that aligns with your financial goals and circumstances.

What is Unum Life Insurance?

Unum Life Insurance is a subsidiary of Unum Group, a leading provider of financial protection benefits. Unum offers a range of life insurance products, including term life, whole life, and universal life insurance. These policies provide coverage for a specified period or your entire life, with the added benefit of accumulating cash value over time.

One of the key features of Unum Life Insurance is its cash value component. As you pay premiums, a portion of the premium goes towards the death benefit, while the rest goes into a cash value account. This cash value grows tax-deferred over time, based on the performance of the insurer’s investment portfolio.

The cash value component of Unum life insurance policies offers policyholders several benefits, including the ability to borrow against the cash value. This feature allows policyholders to access funds for various needs, such as paying off debt, covering medical expenses, or supplementing retirement income, without having to surrender the policy.

How Borrowing Against Your Unum Life Insurance Works?

Borrowing against your Unum life insurance policy is a straightforward process that can provide you with access to cash when you need it. Here’s how it works:

Accumulating Cash Value

When you pay premiums on your Unum life insurance policy, a portion of the premium is allocated to the cash value account. Over time, this cash value grows tax-deferred based on the performance of the insurer’s investment portfolio.

Loan Availability

Once your policy has accumulated sufficient cash value, you have the option to borrow against this cash value. Unum typically allows policyholders to borrow up to a certain percentage of the cash value, which varies based on the policy terms and conditions.

Loan Terms

When you borrow against your Unum life insurance policy, you’re essentially borrowing from yourself. This means there’s no need for a credit check or approval process. The loan is typically repaid with interest, which is also credited back to your cash value account.

Repayment

You have the flexibility to repay the loan on your own schedule. If you don’t repay the loan, the outstanding balance will be deducted from the death benefit paid to your beneficiaries when you pass away.

How Much Does Life Isurance Cost?

Impact on Policy

Borrowing against your Unum life insurance policy can reduce the cash value and death benefit of your policy. It’s important to weigh the pros and cons and have a clear repayment plan in place to avoid any negative consequences.

How to Borrow Against Your Unum Life Insurance?

Borrowing against your Unum life insurance policy is a relatively simple process. Here’s a step-by-step guide to help you understand how to borrow against your policy:

1- Check Your Policy

Review your Unum life insurance policy to determine if it has a cash value component and if borrowing against the policy is allowed. Not all policies offer this option, so it’s essential to understand your policy’s terms and conditions.

2- Determine Loan Amount

Contact Unum or your insurance agent to find out the maximum amount you can borrow against your policy. This amount is typically a percentage of the cash value, and there may be a minimum loan amount requirement.

3- Loan Application

Fill out a loan application provided by Unum. You may need to provide personal information and details about your policy, including the policy number and the amount you wish to borrow.

4- Loan Approval

Once your loan application is submitted, Unum will review your request. Approval is usually quick since you’re borrowing against your own policy’s cash value, and there’s no need for a credit check.

5- Receive Funds

If your loan is approved, Unum will disburse the loan funds to you. You can typically choose to receive the funds via check or direct deposit.

6- Repayment

You’ll need to repay the loan according to the terms outlined by Unum. This may include paying back the loan with interest, which is credited back to your policy’s cash value.

7- Monitor Your Policy

Keep track of your policy’s cash value and outstanding loan balance. Failing to repay the loan could result in a reduction of your policy’s cash value and death benefit.

Advantages of Borrowing against Your Unum Life Insurance

Borrowing against your Unum life insurance policy can offer several advantages, making it a valuable financial option for policyholders. Here are some key advantages:

Accessibility

Borrowing against your Unum life insurance policy is typically easier and faster than applying for a traditional loan. Since you’re borrowing from your own policy’s cash value, there’s no need for a credit check or approval process.

No Restrictions on Use

The loan proceeds can be used for any purpose you choose, such as paying off debt, covering medical expenses, or funding a home renovation project. There are no restrictions on how you can use the funds.

Low Interest Rates

Life insurance policy loans often have lower interest rates compared to other types of loans, such as personal loans or credit cards. This can result in lower borrowing costs over time.

No Impact on Credit Score

Since you’re borrowing against your own policy, the loan does not appear on your credit report. This means that borrowing against your Unum life insurance policy will not impact your credit score.

Flexible Repayment Options

Unum typically offers flexible repayment options for policy loans. You can choose to repay the loan on a schedule that works for you, and you can also repay the loan early without incurring prepayment penalties.

Maintains Life Insurance Coverage

Borrowing against your Unum life insurance policy allows you to access funds while maintaining your life insurance coverage. This can provide peace of mind knowing that your loved ones will still receive a death benefit when you pass away.

Overall, borrowing against your Unum life insurance policy can be a convenient and cost-effective way to access funds when you need them. However, it’s essential to weigh the advantages against the potential drawbacks and consider your individual financial situation before taking out a policy loan.

Disadvantages of Borrowing against Your Unum Life Insurance

While borrowing against your Unum life insurance policy can offer several advantages, there are also some disadvantages to consider. It’s important to weigh these disadvantages against the benefits before deciding to borrow against your policy. Here are some potential drawbacks:

Reduction in Death Benefit

When you borrow against your Unum life insurance policy, the outstanding loan balance is deducted from the death benefit paid to your beneficiaries when you pass away. This means that your beneficiaries may receive a reduced benefit if you don’t repay the loan.

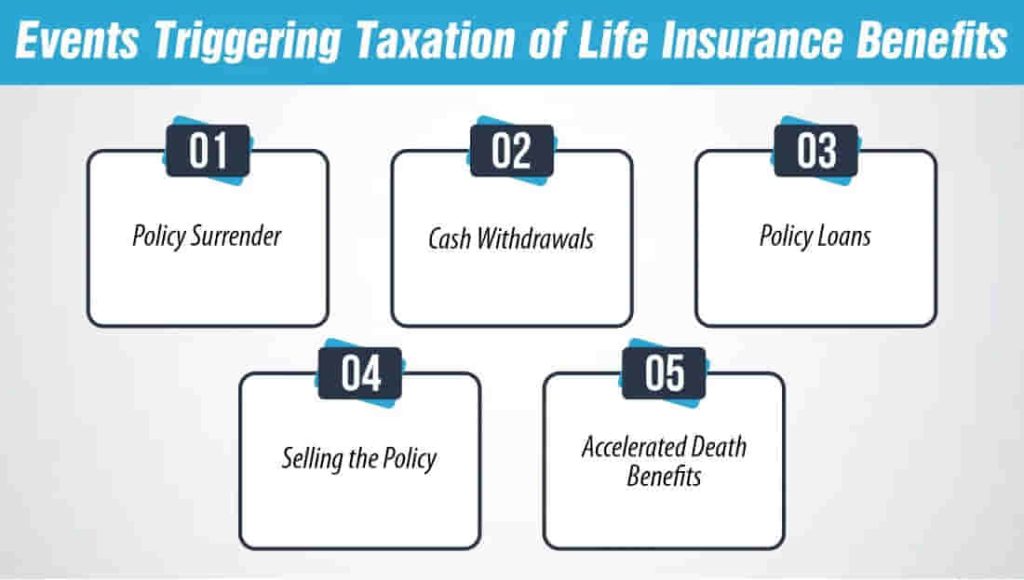

Tax Implications

While the loan itself is not taxable, if your policy lapses or is surrendered with an outstanding loan balance, the loan amount could be considered taxable income. This could result in a tax bill that you weren’t expecting.

Risk of Policy Lapse

Failing to repay the loan could result in your policy lapsing, which means you could lose your life insurance coverage altogether. This could leave you without the protection you need if something were to happen to you.

Impact on Cash Value

Borrowing against your Unum life insurance policy can reduce the cash value of your policy. This can limit your ability to access funds in the future or could affect the performance of your policy.

Interest Charges

While life insurance policy loans often have lower interest rates compared to other types of loans, you will still be charged interest on the loan balance. This adds to the cost of borrowing and reduces the amount of cash value available in your policy.

Potential Alternatives

Before borrowing against your Unum life insurance policy, it’s important to explore other borrowing options, such as personal loans or lines of credit. These alternatives may offer more favorable terms or have fewer potential drawbacks.

While borrowing against your Unum life insurance policy can be a convenient way to access funds, it’s essential to consider the potential disadvantages and carefully weigh your options before making a decision.

Things to Consider Before Borrowing Against Your Unum Life Insurance

Before borrowing against your Unum life insurance policy, there are several important factors to consider. Taking the time to understand these considerations can help you make an informed decision that aligns with your financial goals. Here are some key things to think about:

Loan Repayment Plan: Have a clear plan for repaying the loan. Failing to repay the loan could result in a reduction of your policy’s cash value and death benefit, or even the lapse of your policy.

Loan Terms: Understand the terms of the loan, including the interest rate, repayment period, and any fees. Compare these terms to other borrowing options to ensure you’re getting the best deal.

Impact on Policy: Consider how borrowing against your policy will affect its cash value, death benefit, and overall performance. Will the loan impact your ability to access funds or affect the growth of your policy’s cash value?

Alternatives: Explore other borrowing options, such as personal loans or lines of credit, to compare rates and terms. Consider whether these alternatives might be a better fit for your financial situation.

Financial Stability: Assess your current financial situation to ensure you can afford to repay the loan. Consider factors such as your income, expenses, and any other financial obligations you have.

Consultation: Before making a decision, consider consulting with a financial advisor. An advisor can help you understand the potential impact of borrowing against your policy and explore alternative options.

By carefully considering these factors, you can make an informed decision about whether borrowing against your Unum life insurance policy is the right choice for you.

Final Thoughts

Borrowing against your Unum life insurance policy can provide a valuable source of funds when needed, but it’s essential to weigh the pros and cons carefully. Understanding how this option works, its potential impact on your policy, and having a repayment plan in place are key factors to consider. Before making any decisions, it’s advisable to consult with a financial advisor to assess your individual circumstances and explore all available options.

References:

https://forms.unum.com/StreamPDF.aspx?strURL=/194550-4.pdf&strAudience=EMPLOYER

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.