Can Power of Attorney Change Life Insurance Beneficiary?

Last Updated on: September 18th, 2024

- Licensed Agent

- - @InsureGuardian

In this blog, you will learn:

- What a power of attorney (POA) is and the authority it grants.

- The policy owner is the only person who can change the beneficiary designation in most cases.

- If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes.

- A power of attorney can give someone else the ability to change your beneficiaries.

- Different types of POA and how they apply to life insurance.

- Whether a power of attorney can change life insurance beneficiaries.

- The legal factors, such as state laws and insurance company policies, that influence a POA’s authority over beneficiary changes.

- Steps involved in can power of attorney change life insurance beneficiary

- Tips to protect your interests when granting a POA.

- Common risks associated with allowing a POA to modify life insurance beneficiaries.

Can someone with power of attorney change your life insurance beneficiary? It’s a thought that might not cross your mind until it’s too late. Life insurance is meant to protect your loved ones, ensuring they receive financial support when you’re gone.

However, granting someone power of attorney introduces complexities. This legal document gives someone else control over your financial decisions, but can power of attorney change life insurance beneficiary? Understanding the relationship between power of attorney and life insurance is crucial. It helps you safeguard your intentions and provides peace of mind that your loved ones will be taken care of according to your wishes.

Table of Contents

ToggleLet’s explore the nuances of this important issue.

What is Power of Attorney?

A power of attorney (POA) is a legal document that allows you to appoint someone else to act on your behalf in various matters. This person, known as the “agent” or “attorney-in-fact,” is given the authority to make decisions for you, whether they’re financial, legal, or medical. The scope of this authority can vary significantly depending on the type of power of attorney you establish.

Can power of attorney change beneficiary on life insurance? A power of attorney (POA) can only change the beneficiary on life insurance if the document gives them that authority. To avoid legal issues, it's important to review the POA carefully and consult with the insurance company to confirm their policy on beneficiary changes.

Types of Power of Attorney

There are several types each with unique characteristics and serving specific purposes. Here’s a closer look at some of the types of POA:

1- General Power of Attorney

A General Power of Attorney grants broad powers to the agent, enabling them to handle a wide range of activities on your behalf. These powers can include managing bank accounts, signing checks, selling property, managing real estate, filing taxes, and more. It’s typically used when you need someone to handle all your affairs during a period when you are unavailable, such as an extended trip abroad. However, this type of POA terminates if you become incapacitated.

2- Limited Power of Attorney

A Limited Power of Attorney, also known as a Special Power of Attorney, grants the agent authority to perform specific tasks. For instance, you might give someone the authority to manage a particular real estate transaction, handle a single financial transaction, or act on your behalf in a specific legal matter. This type of POA is very precise and only applies to the tasks explicitly stated in the document.

How Much Does Life Isurance Cost?

3- Durable Power of Attorney

A Durable Power of Attorney remains in effect even if you become incapacitated. This type of POA is particularly important for ensuring that your affairs can be managed continuously without the need for court intervention if you are unable to make decisions due to illness or injury. The durable nature of this POA means that your agent can continue to act on your behalf as needed, providing a seamless transition in managing your affairs.

4- Springing Power of Attorney

A Springing Power of Attorney only becomes effective under certain conditions, typically your incapacitation. This type of POA “springs” into action when a specific event occurs, as defined in the document. It provides a safeguard by ensuring that the agent only has authority when absolutely necessary. For example, the document might specify that the POA becomes effective when a doctor certifies that you are no longer capable of making decisions.

Can Power of Attorney Change Life Insurance Beneficiary?

Yes, a power of attorney (POA) can potentially change the beneficiary of a life insurance policy, but it depends on several factors.

- Specific Authority: The POA document must explicitly grant the agent the power to change beneficiaries. If this authority is not included, the agent cannot make changes to the beneficiary designation.

- State Laws: State laws vary regarding the extent of authority granted to agents under a POA. Some states may allow agents to change beneficiaries, while others may have restrictions or require specific language in the POA document.

- Insurance Company Policies: Insurance companies have their own rules and procedures regarding beneficiary changes. Some may require additional documentation or verification before accepting a change requested by an agent under a POA.

- Beneficiary Designation: If the life insurance policy is part of an employee benefit plan, such as through an employer, the plan documents may specify who has the authority to change beneficiaries. In such cases, the terms of the plan would dictate whether the agent under a POA can make changes.

It’s crucial to review the POA document, state laws, and the insurance policy’s terms to determine if the agent has the authority to change the beneficiary. Consulting with an attorney or financial advisor can provide clarity and ensure that any changes comply with applicable laws and regulations.

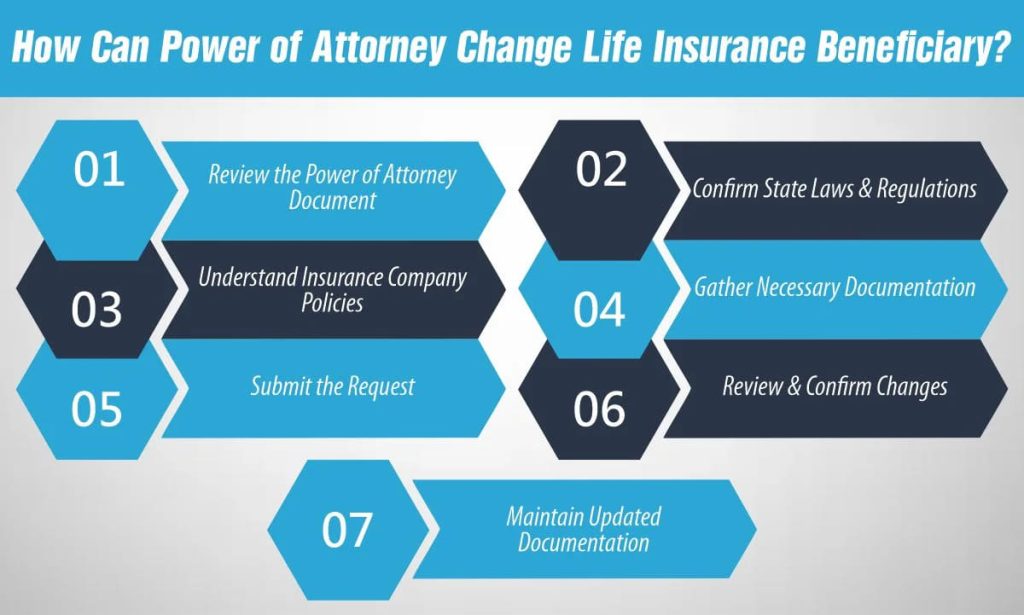

How Can Power of Attorney Change Life Insurance Beneficiary?

Changing a life insurance beneficiary through a power of attorney involves several steps and considerations. Here’s a breakdown of how this process typically works:

1. Review the Power of Attorney Document

First, review the language of the power of attorney (POA) document. It must explicitly grant the agent the authority to make changes to life insurance beneficiaries. If the POA does not specifically mention this power, the agent may not have the authority to alter beneficiaries.

2. Confirm State Laws and Regulations

State laws and regulations play a significant role in determining whether an agent can change a life insurance beneficiary. Some states have strict rules about what powers an agent can exercise, including changing beneficiaries. Familiarize yourself with the laws in your state to understand the extent of the agent’s authority.

3. Understand Insurance Company Policies

Each insurance company has its policies regarding changes to beneficiaries. Some companies may allow agents to make changes with proper documentation and authorization, while others may have more strict requirements or prohibit agents from altering beneficiaries altogether. Contact the insurance company directly to understand their specific procedures and requirements.

4. Gather Necessary Documentation

If the POA grants the agent the authority to change beneficiaries and the insurance company permits such changes, gather the necessary documentation. This typically includes a written request to change beneficiaries, along with any supporting documentation required by the insurance company, such as a copy of the POA document and proof of the agent’s identity.

5. Submit the Request

Once you have gathered all the necessary documentation, submit the request to the insurance company according to their specified procedures. Be sure to follow any instructions provided by the company and include all required information to ensure the request is processed promptly.

6. Review and Confirm Changes

After submitting the request, carefully review any confirmation or acknowledgment received from the insurance company. Confirm that the changes to the beneficiaries have been accurately processed and reflect your intentions. If there are any discrepancies or issues, follow up with the insurance company to address them promptly.

7. Maintain Updated Documentation

Finally, it’s essential to keep all documentation related to the change of beneficiaries, including copies of the POA document, correspondence with the insurance company, and any other relevant records. This ensures clarity and transparency regarding the changes made and helps prevent disputes or misunderstandings in the future.

These are the steps on can a power of attorney change a life insurance beneficiary. Cover all the steps to complete the process.

Tip:

‘Check state law. State laws vary on the powers allowed under a POA. Confirm whether your state permits agents to alter life insurance beneficiaries.’

Steps to Protect Your Interests

Protecting your interests when granting power of attorney involves careful planning and consideration. Here are steps you can take to ensure your wishes are honored and your assets are safeguarded:

Clearly Define the Agent’s Powers

When drafting a power of attorney (POA) document, clearly define the scope of the agent’s powers. Specify which actions the agent can and cannot take on your behalf. If you do not want the agent to change life insurance beneficiary as power of attorney, explicitly state this in the document.

Choose a Trusted Agent

Select an agent who is trustworthy, reliable, and understands your wishes. Consider their ability to handle financial matters responsibly and make decisions in your best interests.

Consider a Limited or Specific POA

If you have specific tasks or transactions that require attention, consider granting a limited or specific POA for those purposes. This limits the agent’s authority to only those actions you designate.

Monitor the Agent’s Actions

Stay informed about the agent’s actions and decisions. Regularly review bank statements, financial transactions, and any changes made to legal documents or beneficiaries.

Communicate Your Wishes Clearly

Discuss your wishes with your agent and other family members. Ensure everyone understands your intentions regarding your assets, including life insurance policies and beneficiaries.

Review and Update Documents Regularly

Regularly review your POA and beneficiary designations to ensure they reflect your current wishes. Update them as needed to account for changes in your life circumstances or relationships.

Seek Legal Advice

Consult with an attorney who specializes in estate planning and elder law. They can guide how to structure your POA to best protect your interests and ensure your wishes are legally enforceable.

Consider Alternatives to POA

In some cases, alternatives to a POA, such as a living trust or joint ownership, may better suit your needs. Discuss these options with your attorney to determine the best course of action.

By taking these steps, you can protect your interests and ensure that your wishes are respected when granting power of attorney.

Conclusion

Looking for can power of attorney change life insurance beneficiary? Well! The ability of a power of attorney to change a life insurance beneficiary is complex. It depends on the language of the POA document, state laws, and insurance company policies. Given the potential risks, it’s essential to proceed with caution.

Clearly define your agent’s powers, choose a trustworthy agent, and regularly review your documents. By taking these steps, you can ensure your life insurance benefits go to the right person, providing peace of mind for you and your loved ones.

Frequently Asked Questions (FAQs)

1- What Are the Risks of Allowing a Power of Attorney to Change a Life Insurance Beneficiary?

Allowing a power of attorney to change a life insurance beneficiary can pose several risks. There’s a potential for abuse of power, where the agent may change the beneficiary for their own benefit. It can also lead to family disputes if the change is made without the knowledge or consent of other family members.

2- How often should I review my power of attorney and beneficiary designations?

It’s advisable to review your power of attorney and beneficiary designations regularly, at least once a year or whenever significant life events occur, such as marriage, divorce, birth, or death in the family. This ensures that your documents reflect your current wishes and circumstances.

3- What should I do if I have concerns about my power of attorney?

If you have concerns about your power of attorney or the actions of your agent, seek legal advice promptly. An attorney can review your documents, address any issues or discrepancies, and provide guidance on how to protect your interests and rights effectively.

4- Does power of attorney allow changes of life insurance beneficiaries?

A power of attorney (POA) can enable adjustment of life insurance beneficiaries in case the document expressly permits the action. However, this power is not included in many POAs, and some insurance companies may ask for further confirmation.

5- Can a power of attorney be a beneficiary in a will?

A beneficiary is an individual that you have named in your Will to receive certain items upon your death. You can nominate any person as a beneficiary; even if the person owns a power of attorney.

6- Can a power of attorney change beneficiary to himself?

A power of attorney (POA) usually can’t change the beneficiary to themselves unless the POA specifically permits them. Even if allowed, this can be closely examined to make sure there’s no fraud or conflict of interest.

References:

- https://www.lifeinsuranceattorney.com/blog/2022/august/can-a-power-of-attorney-poa-life-insurance-benef/#:~:text=An%20agent%20holding%20a%20POA,payout%20to%20the%20decedent’s%20estate.

- https://www.policygenius.com/life-insurance/can-you-change-your-life-insurance-beneficiary/

- https://www.calalaw.com/blog/can-a-power-of-attorney-change-a-life-insurance-beneficiary/#:~:text=In%20general%2C%20a%20POA%20authorizes,activities%20stipulated%20in%20the%20document.

- https://www.fieldlaw.com/News-Views-Events/195402/Can-a-Power-of-Attorney-Change-a-Beneficiary-on-a-Life-Insurance-Policy

- https://www.lifeinsuranceattorney.com/blog/2022/august/can-a-power-of-attorney-poa-life-insurance-benef/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.