Graves’ Disease Life Insurance: Understanding Coverage Options

Securing life insurance is akin to safeguarding your loved ones’ future, a financial parachute ready to deploy when life takes an unexpected turn. However, for individuals diagnosed with Graves’ disease, navigating the terrain of life insurance can feel like a perplexing maze. Imagine trying to secure a safety net while balancing on a tightrope; a bit daunting, right?

But fear not! This comprehensive guide is your compass, shedding light on the intricacies of Graves’ disease life insurance. We’ll unravel the mysteries surrounding this autoimmune condition, debunk myths about its impact on insurance eligibility, explore available coverage options, and provide insights into the application process post-diagnosis.

Whether you’re new to the world of insurance or a seasoned player grappling with Graves’ disease, this blog aims to demystify complexities, offering a roadmap to help you navigate the often challenging landscape of obtaining life insurance coverage. So, let’s dive in and unravel the secrets to securing your financial future despite the challenges of Graves’ disease.

What is Graves’ Disease?

Graves’ disease is an autoimmune disorder primarily affecting the thyroid gland, a small butterfly-shaped organ located in the neck. This condition leads to the overproduction of thyroid hormones, primarily thyroxine (T4), and triiodothyronine (T3). The excessive release of these hormones into the bloodstream triggers an acceleration of the body’s metabolism, causing various symptoms and affecting numerous bodily functions.

Graves’ disease is caused by an abnormal immune system response that mistakenly attacks the thyroid gland, leading to its overstimulation and the excessive production of hormones. While treatable, it requires ongoing management through medication, radioactive iodine therapy, or in severe cases, surgery. Regular monitoring and treatment adjustments are necessary to maintain thyroid hormone levels within the normal range and manage associated symptoms effectively.

Can you get Graves’ Disease Life Insurance?

Yes, individuals diagnosed with Graves’ disease can typically obtain life insurance coverage. However, the process might be more complex due to the perceived higher risk associated with the condition.

When applying for Graves’ disease life insurance, the insurer will assess various factors to determine the risk level associated with providing coverage. They will likely consider:

- Medical History: Details regarding the diagnosis, treatment, and management of Graves’ disease.

- Current Health Status: Overall health, any complications, and the effectiveness of treatment.

- Compliance with Treatment: Adherence to prescribed medications and regular medical check-ups.

- Severity of the Condition: The extent to which Graves’ disease has affected the individual’s health.

Based on these factors, insurers may adjust premiums or terms of coverage. In some cases, individuals with Graves’ disease may face higher premiums due to the perceived increased risk. However, each insurance company has its own underwriting criteria, and some may specialize in offering coverage for individuals with pre-existing conditions like Graves’ disease.

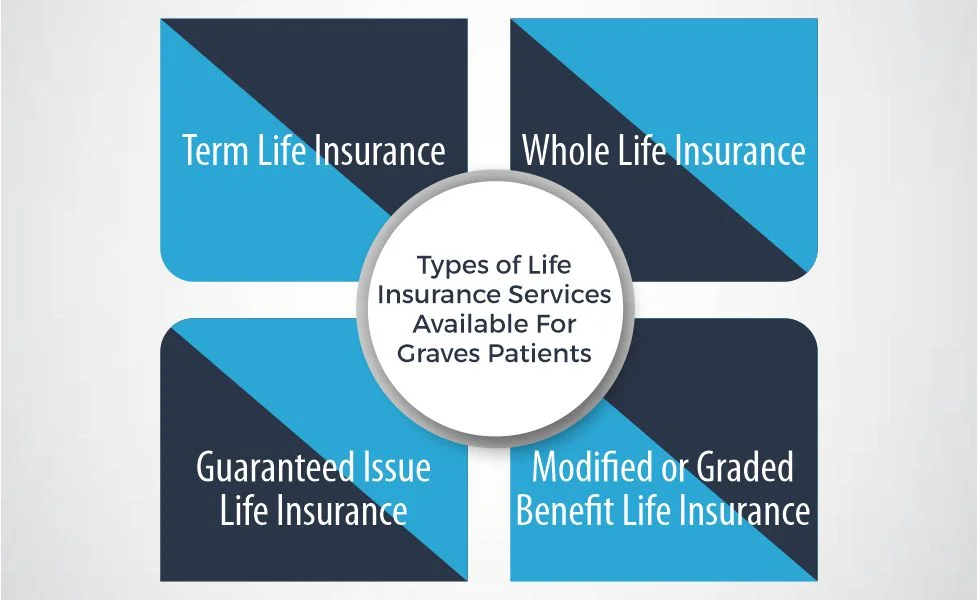

Types of Life Insurance Services Available for Graves’ Patients

Individuals diagnosed with Graves’ disease have various life insurance options available, albeit with certain considerations due to the perceived higher risk associated with the condition. Here are some types of Graves’ disease life insurance services that may be accessible to Graves’ patients:

1- Term Life Insurance

This type of insurance provides coverage for a specified period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away within the term. Individuals with Graves’ disease might find term life insurance more accessible, especially if the condition is well-managed.

How Much Does Life Isurance Cost?

2- Whole Life Insurance

Unlike term life insurance, whole life insurance covers the insured individual for their entire life. It includes a cash value component that grows over time, and premiums usually remain consistent. However, obtaining whole life insurance with Graves’ disease might be more challenging and could come with higher premiums.

3- Guaranteed Issue Life Insurance

This type of insurance doesn’t require a medical exam or health questions. It’s designed for individuals who might have difficulty obtaining coverage due to health conditions like Graves’ disease. While it offers guaranteed acceptance, it typically has lower coverage amounts and higher premiums compared to other types of policies.

4- Modified or Graded Benefit Life Insurance

These policies provide coverage but usually come with a waiting period before the full death benefit becomes available. They might be an option for individuals with Graves’ disease, albeit with limitations and potentially higher premiums.

How Much is Graves’ Disease Life Insurance? Cost

The cost of life insurance for individuals with Graves’ disease can vary significantly based on several factors, including the severity of the condition, overall health status, age, type of insurance, coverage amount, and the insurance provider’s underwriting policies.

Generally, individuals with Graves’ disease might encounter higher insurance premiums compared to those without pre-existing health conditions. The perceived higher risk associated with the condition might result in increased premiums to offset the insurer’s potential risk.

Below is a table showcasing premium estimates for different age brackets and coverage amounts:

| Age Group | Coverage Amount | Term Length | Estimated Monthly Premiums (Non-Smoker) |

| 30-39 | $100,000 | 20 years | $30 – $60 |

| 30-39 | $250,000 | 20 years | $50 – $90 |

| 40-49 | $100,000 | 20 years | $40 – $80 |

| 40-49 | $250,000 | 20 years | $70 – $120 |

| 50-59 | $100,000 | 20 years | $80 – $150 |

| 50-59 | $250,000 | 20 years | $130 – $250 |

Please note: These premium estimates are hypothetical and can significantly vary based on individual circumstances, including the severity of Graves’ disease, overall health, and insurer-specific underwriting criteria. Individuals with pre-existing conditions like Graves’ disease might face higher premiums due to perceived higher risk levels.

Why do Insurers Care if You Have Been Diagnosed with Graves’ Disease?

Insurers carefully assess the health status and medical history of applicants, including diagnoses like Graves’ disease, to evaluate the risk associated with providing life insurance coverage. There are several reasons why insurers consider pre-existing conditions like Graves’ disease when underwriting policies:

Risk Assessment

Insurers aim to evaluate the potential risk of claims being made against the policy. Graves’ disease, if not properly managed, can lead to various health complications, impacting longevity and potentially increasing the likelihood of claims.

Health Impact

Graves’ disease can affect various bodily functions and overall health. Insurers want to understand the severity of the condition and how it might influence life expectancy or lead to other health complications.

Treatment and Management

Effective management and treatment compliance are crucial in controlling Graves’ disease. Insurers assess whether the individual is receiving appropriate treatment, adhering to medications, and regularly visiting healthcare providers to manage the condition.

Potential Complications

If left untreated or poorly managed, Graves’ disease can lead to complications such as heart problems, osteoporosis, and eye-related issues (Graves’ ophthalmopathy). Insurers evaluate the potential impact of these complications on the insured individual’s health and life expectancy.

Statistical Risk Assessment

Insurers rely on actuarial data and statistical models to assess risk. Certain medical conditions, including Graves’ disease, might be statistically associated with higher mortality rates or increased healthcare costs, influencing the insurance premiums or coverage terms.

Underwriting Guidelines

Each insurance company has its own underwriting guidelines and risk tolerance. These guidelines determine how they evaluate and price policies based on various health conditions, including Graves’ disease.

How to Apply for a Graves’ Disease Life Insurance Plan After Getting Diagnosed with Graves’ Disease?

Applying for a life insurance plan after being diagnosed with Graves’ disease requires careful consideration and thorough preparation. Follow these steps to navigate the application process effectively:

Gather Medical Information

Collect comprehensive medical records related to your Graves’ disease diagnosis, treatment history, medications, and any relevant test results. This information helps insurers assess the severity and management of your condition.

Research Insurers Specializing in Pre-existing Conditions

Identify insurance companies or agents experienced in handling cases involving pre-existing health conditions like Graves’ disease. Working with professionals familiar with high-risk cases can improve your chances of finding suitable coverage.

Consult an Insurance Professional

Schedule a consultation with an insurance agent or broker specializing in high-risk cases. Discuss your health history, treatment compliance, and any lifestyle changes you’ve made to manage your condition. They can guide you through available options and provide insights into insurer preferences.

Be Transparent and Provide Accurate Information

During the application process, honesty is crucial. Disclose all relevant health information, including your Graves’ disease diagnosis, treatments, medications, and any related complications. Providing accurate details helps insurers assess your risk profile accurately.

Undergo Medical Examinations if Required

Depending on the insurer and the coverage amount, a medical exam might be necessary. This examination can include blood tests, urinalysis, and possibly a physical examination. Cooperate fully and follow any pre-examination instructions provided by the insurer.

Review Policy Options Carefully

Once you receive policy offers, carefully review the coverage terms, premiums, limitations, and any exclusions related to Graves’ disease. Understand the policy’s provisions and ensure they align with your needs.

Consider Multiple Quotes

Don’t hesitate to request quotes from different insurers. Compare the coverage options, premiums, and terms offered by different companies to find the most suitable plan for your situation.

Submit Application and Follow-Up

Complete the application accurately and submit it along with any required documents. Follow up with the insurer or your agent regularly to check the status of your application and address any additional requirements or inquiries promptly.

Remember, obtaining life insurance with Graves’ disease might involve additional scrutiny and potentially higher premiums due to perceived increased risk. However, by being proactive, transparent, and seeking guidance from insurance professionals, you can increase your chances of securing appropriate coverage that meets your needs.

Frequently Asked Questions (FAQs)

1- Is Graves’ Disease a Life-Threatening Disease?

While Graves’ disease can significantly impact one’s health, it’s not typically considered a life-threatening illness when managed effectively. With proper treatment and care, many individuals live fulfilling lives.

2- What is Life Expectancy with Graves’ Disease?

With proper management and treatment, individuals with Graves’ disease can have a normal life expectancy. However, the impact of the condition on life expectancy may vary based on individual health factors and the effectiveness of treatment.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.