Open Care Final Expense Plans review 2024

OpenCare stands out as a dedicated life insurance provider, offering coverage for various financial concerns that may arise in the future. Whether it’s addressing final expenses or ensuring your family’s financial stability, OpenCare is a player in the competitive insurance market. To make an informed decision, let’s delve into the specific features of OpenCare’s life insurance options.

Life insurance holds a pivotal role in personal finance, making it a crucial consideration for those mindful of their financial well-being. This financial safeguard steps in after the policyholder’s demise, providing designated beneficiaries with a lump-sum payment in exchange for regular premium payments. Let’s explore the key aspects of OpenCare’s offerings to empower your decision-making process.

Insurance Plans for Open Care Final Expense Plans in 2024

Open Care offers insurance plans for final expenses. These plans are designed to help seniors and their families cover end-of-life expenses such as funeral and burial expenses. These plans typically provide a lump sum payment to the beneficiary upon the policyholder’s death, which can be used to cover these expenses.

Open care senior plans are typically available to seniors between 50 and 85 and do not require a medical exam for approval. The premiums are generally affordable and fixed, and the policies are guaranteed renewal for the insured’s lifetime.

These plans may offer additional benefits such as accidental death coverage, terminal illness riders, and cash value accumulation. Such benefits provide additional financial support to seniors and their families during difficult times.

Note that Open Care’s final expense insurance plans may vary depending on location and circumstances. It is wise to contact Open Care directly or consult a licensed insurance agent. This will enable you to learn more about the available options and which plan best suits your needs.

Types of Open Care Final Expense

Life insurance comes in two primary types: term life insurance and whole life insurance.

Open Care Term Life Insurance Policies

OpenCare introduces an economical term life insurance policy, strategically crafted to provide protection for a specified duration. In the unfortunate event of the policyholder’s demise during this term, beneficiaries receive a death benefit. The primary advantages of OpenCare’s term life insurance encompass:

Flexible Terms:

Tailored to align with your current life stage and budget, enjoy the convenience of choosing terms that suit your unique circumstances.

Affordable Premiums:

OpenCare ensures accessibility to life insurance with budget-friendly premium payments, offering financial security without straining your finances.

No Medical Examination:

Simplifying the process, OpenCare’s term life insurance eliminates the need for a medical examination, providing a seamless and straightforward experience for policyholders.

How Much Does Life Isurance Cost?

Open Care Whole Life Insurance

Open Care’s whole life insurance offers lifelong coverage with a guaranteed fixed premium, accompanied by a growing cash value component that accrues tax-deferred over time, providing an additional financial resource. Key advantages of whole life insurance encompass:

- Lifetime coverage

- Access to a cash value for potential loans

- Guaranteed death benefit

It’s essential to keep in mind that while whole life insurance provides comprehensive benefits, it generally comes with higher costs compared to term life insurance policies.

How Do Open Care Final Expense Plans Work?

Open Care’s final expense insurance plans provide a lump sum payment to the designated beneficiary upon the insured’s death. This payment can be used to cover end-of-life expenses, such as funeral and burial costs, as well as any other expenses the beneficiary may need to cover.

To enroll in an Open Care life insurance plan, the applicant typically needs to answer a few health-related questions, but no medical exam is required. Once approved, the policyholder pays a fixed monthly premium for the duration of the policy. This premium is typically guaranteed to be renewable for their lifetime.

If the policyholder passes away, the designated beneficiary will receive the agreed-upon lump sum payment. This payment can be used to cover any expenses related to their final arrangements or other financial obligations. However, the payment amount depends on the coverage amount and the policy’s specific terms.

Meanwhile, Open Care’s final expense insurance plans may have specific limitations and exclusions. These limitations and exclusions may include waiting for periods or restrictions on death causes. It is imperative to review the policy’s specific terms carefully and consult with a licensed insurance agent if you have questions or concerns.

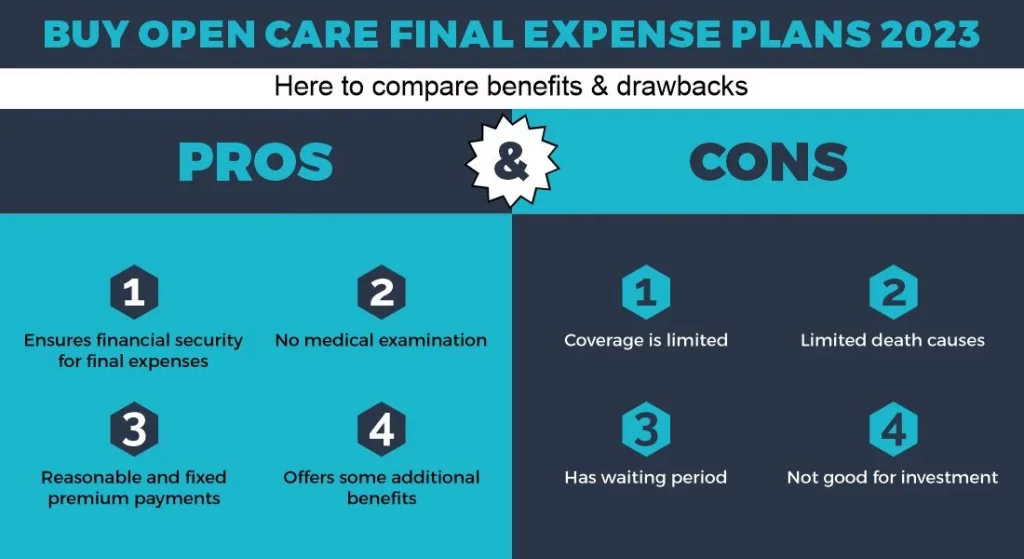

Pros and Cons of Open Care Final Expense Plan

Here are some potential pros and cons of Open Care’s life insurance plan:

Pros:

Provides financial support for end-of-life expenses: The lump sum payment from the policy can help cover funeral and burial costs, relieving the financial burden on loved ones.

No medical exam required: Approval of the policy is based on answering health-related questions, which can make it more accessible to seniors with health issues.

Affordable and fixed premiums: The premiums are generally affordable and fixed for the policy’s duration, making it easier to budget for and plan around.

Additional benefits may be available: Open Care’s final expense insurance plans may offer additional benefits, such as accidental death coverage, which can provide additional financial support in difficult times.

Cons:

Limited coverage amount: The coverage amount for final expense insurance plans is typically lower than traditional life insurance plans, which may need more to cover all end-of-life expenses.

The waiting period may apply: Some final expense insurance plans may have a waiting period before the full benefit is available, limiting its usefulness in sudden death cases.

Restrictions on the cause of death: These plans may have exclusions or restrictions on the cause of death, which may limit the benefit paid out to the beneficiary.

Not an investment vehicle: Final expense insurance plans do not accrue cash value, which means they are not long-term investment vehicles.

Open Care Final Expense Plan Cost

Open Care strives to deliver cost-effective life insurance solutions to its clients. While specific pricing details are provided through personalized quotes, several key factors influence premium costs, including:

Age at application:

The younger you are, the more favorable your premiums are likely to be.

Health status:

While health examinations are not mandatory, disclosing serious health conditions may impact premiums.

Type of policy:

Whole life insurance generally carries higher premiums than term life insurance due to its lifelong coverage and cash value component.

For precise premium amounts tailored to your circumstances, obtain a personalized quote from Open Care.

Open Care Final Expense Plans Reviews

Open Care’s Final Expense insurance plan can help cover funeral expenses and other end-of-life costs, such as medical bills, credit card debt, and other outstanding expenses. The policy’s lump sum eases financial burdens, ensuring full coverage for final expenses, relieving loved ones.

Open Care’s Final Expense insurance plan may offer additional benefits, such as accidental death coverage. This can provide additional financial support in difficult times. The plan also covers funeral expenses, however, in general, the policy can cover expenses such as the casket or urn, the funeral or memorial service, transportation of the deceased, and other related expenses.

It is imperative to carefully review the terms and limitations of the policy and consult with a licensed insurance agent. This helps you decide if Open Care’s Final Expense plan suits your needs and situation.

What are Open Care Funeral Plans?

Open Care Funeral Plans offers thoughtful solutions to plan your final goodbye in advance. Open Care enables people to pre-plan and pay for their funerals in advance, securing that their wishes are honored and that their loved ones are relieved of the emotional and financial burden during a very hard time. These plans cover the different parts of a funeral and provide a convenient and inexpensive way to make a meaningful tribute. Choosing Open Care Funeral Insurance plans gives you peace of mind, knowing that your arrangements are in place and your family is supported, and makes the very hard time a little easier for everyone involved.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.