How to Cancel Legal and General Life Insurance: Complete Guide

Last Updated on: August 1st, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

Are you considering canceling your Legal and General life insurance policy? Whether you’ve found a better deal, no longer need the coverage, or simply want to explore your options, canceling your policy can be a straightforward process if you know what steps to take.

Table of Contents

ToggleLegal and General offers various life insurance policies designed to protect your loved ones financially in the event of your death. However, circumstances change, and you may find yourself needing to cancel your policy for various reasons.

In this comprehensive guide, we will walk you through the step-by-step process of how to cancel Legal and General life insurance policy. We will also discuss the key features and benefits of Legal and General life insurance, reasons for cancellation, terms and conditions regarding cancellation, and much more.

Let’s explore together!

What is Legal and General Life Insurance, and How Does It Work?

Legal and General Life Insurance is a type of insurance policy that provides financial protection for your loved ones in the event of your death. It works by paying out a lump sum, known as a death benefit, to your beneficiaries upon your passing. This money can be used to cover funeral expenses, and outstanding debts, or provide financial security for your family.

When you purchase a Legal and General life insurance policy, you agree to pay a monthly or annual premium to the insurance company. In return, Legal and General agree to pay out a predetermined sum of money to your beneficiaries when you die, as long as the policy is in force and the premiums are up to date.

Key Features and Benefits of Legal and General Life Insurance Policies

Legal and General Life Insurance policies offer several key features and benefits, making them a popular choice for individuals seeking financial protection for their loved ones. Here are some of the key features and benefits of Legal and General Life Insurance policies:

1- Flexible Coverage Options

Legal and General offers a variety of life insurance products, including term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, while whole life insurance provides coverage for your entire life. This flexibility allows you to choose a policy that meets your specific needs and budget.

How Much Does Life Isurance Cost?

2- Additional Coverage Options

In addition to basic life insurance coverage, Legal and General offer optional riders or add-ons, such as critical illness cover, accidental death benefit, or waiver of premium, which can enhance your policy’s coverage and provide extra financial protection for you and your loved ones.

3- Cash Value Growth

Some whole life insurance policies from Legal and General accumulate cash value over time. A portion of your premium payments goes into a cash value account, which grows tax-deferred. You can borrow against this cash value or use it to supplement your retirement income.

4- Financial Protection for Loved Ones

The primary purpose of life insurance is to provide financial protection for your loved ones in the event of your death. If you pass away while your policy is in force, your beneficiaries will receive a tax-free lump sum payment, known as a death benefit, which can be used to cover funeral expenses, outstanding debts, mortgage payments, and other financial obligations.

5- Flexible-Premium Payments

Legal and General offers flexible premium payment options, allowing you to choose how often you pay your premiums (e.g., monthly, quarterly, annually) and how long you want to pay premiums (e.g., until a certain age or for a specific number of years).

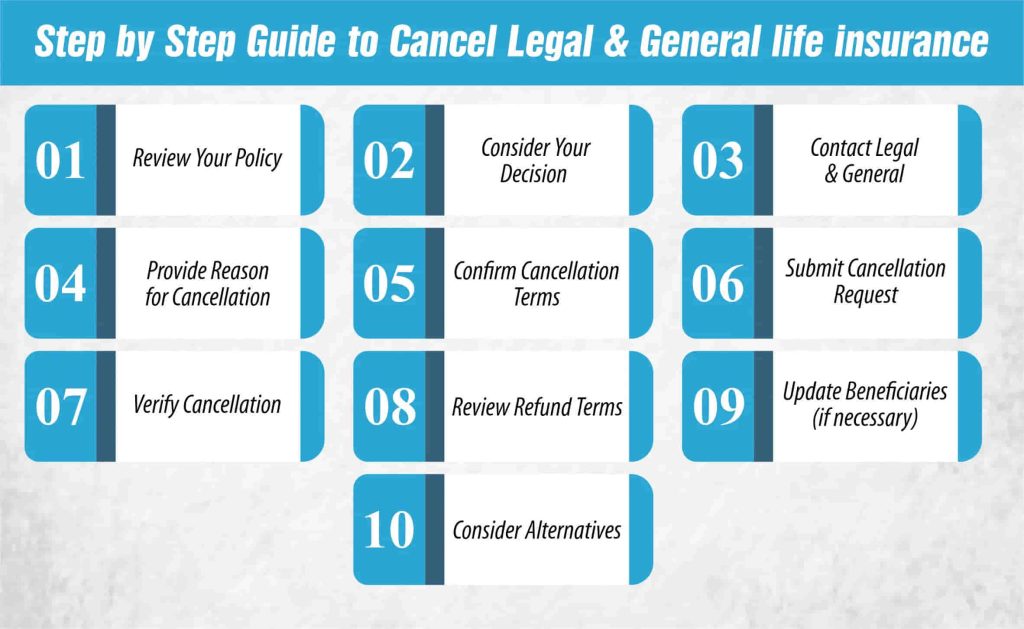

Step-by-Step Guide to Cancel Legal and General Life Insurance

Canceling your Legal and General life insurance policy is a significant decision that requires careful consideration. If you’ve decided to cancel your policy, follow these steps to ensure a smooth process:

Step 1: Review Your Policy

Carefully review your life insurance policy to understand the terms and conditions regarding cancellation. Take note of any fees or penalties associated with cancellation.

Step 2: Consider Your Decision

Consider your decision to cancel carefully. Ensure that canceling your policy is the best course of action for your current financial situation and future needs.

Step 3: Contact Legal and General

Contact Legal and General’s customer service department either by phone or through their website to initiate the cancellation process. Be prepared to provide your policy number and personal information for verification purposes.

Step 4: Provide Reason for Cancellation

You may be asked to provide a reason for canceling your policy. Be honest and provide any necessary information to expedite the process.

Step 5: Confirm Cancellation Terms

Confirm the terms of cancellation with the customer service representative. Ensure that you understand any fees or penalties that may apply.

Step 6: Submit Cancellation Request

Follow the instructions provided by the customer service representative to submit your cancellation request. This may involve completing a cancellation form or providing a written request.

Step 7: Verify Cancellation

After submitting your cancellation request, verify with Legal and General that your policy has been successfully canceled. Request written confirmation of the cancellation for your records.

Step 8: Review Refund Terms

If applicable, review the terms of any premium refunds. Legal and General may issue a refund based on the terms of your policy and the timing of your cancellation.

Step 9: Update Beneficiaries (if necessary)

If you have canceled your policy and no longer require life insurance coverage, consider updating your beneficiaries or revising your estate plan accordingly.

Step 10: Consider Alternatives

If you are canceling your life insurance policy due to financial concerns, consider alternative options such as reducing your coverage amount or exploring other insurance providers.

By following these steps, you can cancel Legal and General life insurance policy efficiently and effectively. Remember to review all terms and conditions carefully and seek advice from a financial advisor if you are unsure about your decision.

Cancel Legal and General Life Insurance Reasons

There are various reasons why you might consider canceling your Legal and General life insurance policy:

Changed Financial Circumstances

If your financial situation has changed, and you can no longer afford the premiums, you may need to cancel your policy to free up some funds.

Coverage No Longer Needed

If your financial obligations have decreased, such as paying off your mortgage or your children becoming financially independent, you may no longer need the coverage provided by your life insurance policy.

Found a Better Policy

You may have found a better life insurance policy elsewhere that offers more comprehensive coverage or lower premiums, prompting you to cancel your current policy.

Health Improvements

If your health has improved since you purchased your life insurance policy, you may be eligible for better rates with a new policy, making it advantageous to cancel your current policy.

Unsatisfactory Service

Should you unhappy with the service or support you’ve received from Legal and General, you may choose to cancel your policy and switch to a different insurance provider.

Change in Beneficiary Needs

If your beneficiaries no longer require financial protection or if your circumstances change, such as a divorce or remarriage, you may need to adjust or cancel your life insurance policy accordingly.

Policy Maturity

For term life insurance policies, if the coverage period has expired, you may decide to cancel the policy as it no longer serves its intended purpose.

To cancel Legal and General life insurance policy, it’s essential to carefully consider your reasons for cancellation and explore alternative options. Additionally, be sure to review the terms and conditions of your policy regarding cancellation fees and any potential consequences of canceling your coverage.

Cancel Legal and General Life Insurance: Advantages and Disadvantages

Cancelling your Legal and General life insurance policy online can offer convenience and efficiency, but it also comes with some drawbacks. Here are the advantages and disadvantages:

Advantages

Convenience: Cancelling online allows you to complete the process from the comfort of your home without the need to visit a branch or speak to a representative over the phone.

Accessibility: Online cancellation is available 24/7, allowing you to cancel your policy at a time that suits you, without having to wait for business hours.

Speed: Online cancellation is often processed more quickly than traditional methods, with some policies being canceled immediately upon submission of the cancellation request.

Paperwork Reduction: Online cancellation typically involves less paperwork and documentation compared to canceling through other methods, streamlining the process.

Disadvantages

Limited Assistance: While online cancellation offers convenience, it may lack the personalized assistance and guidance that you would receive from speaking to a customer service representative.

Technical Issues: There is a risk of encountering technical difficulties or errors when canceling online, which could delay or disrupt the cancellation process.

Complex Policies: For policies with complex terms or conditions, you may find it challenging to navigate the online cancellation process without the guidance of a representative.

Security Concerns: Submitting personal and financial information online carries inherent security risks, such as data breaches or identity theft.

Terms and Conditions of Cancel Legal and General Life Insurance Policies

The terms and conditions of Legal and General life insurance policies regarding cancellation can vary depending on the type of policy you have. However, there are some common elements to be aware of:

Cancellation Period

Legal and General typically allows a “cooling-off” period after purchasing a policy, during which you can cancel the policy and receive a full refund of premiums paid. This period is usually 30 days but may vary.

Cancellation Fees

Depending on the policy, there may be fees associated with canceling your life insurance policy. These fees can vary, so it’s essential to review your policy documents or contact Legal and General directly for specific information.

Refund of Premiums

If you cancel your policy within the cooling-off period, you will usually receive a full refund of any premiums paid. However, if you cancel after this period, the refund may be pro-rated based on the time left on the policy.

Policy Loans

If you have taken out a loan against the cash value of your whole life insurance policy, canceling the policy may require you to repay the loan immediately or have it deducted from any cash value remaining.

Effect on Coverage

Canceling your life insurance policy will terminate your coverage, meaning your beneficiaries will not receive a death benefit if you pass away after the policy is canceled.

It’s essential to review your policy documents carefully and contact Legal and General directly if you have any questions about the terms and conditions regarding cancellation.

The Bottom Line

Hope you are clear about how to cancel Legal and General life insurance. Well! Canceling your Legal and General life insurance policy is a straightforward process that can be completed online or by contacting customer service. Before canceling, it’s essential to review your policy’s terms and conditions and consider any potential consequences. If you’re unsure about canceling, it may be beneficial to speak with a financial advisor to explore your options.

FAQs

1- What is the cooling-off period for Legal and General life insurance policies?

Legal and General offers a cooling-off period, typically 30 days, during which you can cancel your policy and receive a full refund of any premiums paid.

2- What documentation or information is required to initiate the cancellation process?

To cancel your Legal and General life insurance policy, you may need to provide the following documentation or information:

- Policy number

- Personal information

- Reason for cancellation

- Bank details for any premium refunds

3- How can policyholders verify that their policy has been successfully cancelled?

After canceling your Legal and General life insurance policy, you should receive confirmation of the cancellation. You can also contact customer service to verify that the cancellation has been processed successfully.

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.