Suppose you’ve got a life insurance policy you’ve been paying into, thinking it’s a solid backup plan for your family. But then, when it’s needed the most, you hear, “Life insurance will not pay.” Sounds worrying, right? It’s a situation no one wants their loved ones to face. So, why might a life insurance policy not come through in the clutch?

Knowing these reasons can be a game changer, ensuring your safety net is foolproof. Let’s dive into the reasons why life insurance might not pay out and how you can make sure your policy works exactly as you expect it to.

When Life Insurance Will Not Pay?

There are certain conditions under which a life insurance policy might not pay out, leaving beneficiaries in a difficult situation. Common reasons include the policyholder failing to disclose important information about their health or lifestyle when applying, such as smoking status or pre-existing medical conditions. Suicide within the policy’s contestability period, usually the first two years, can also result in a denied claim.

How Much Does Life Isurance Cost?

Additionally, lapses in payment leading to policy cancellation mean no coverage at the time of death. Policies also have specific exclusions; for instance, death resulting from risky activities or illegal behavior might not be covered. It is crucial for policyholders to understand these conditions to ensure their life insurance serves its intended purpose of providing financial security for their loved ones.

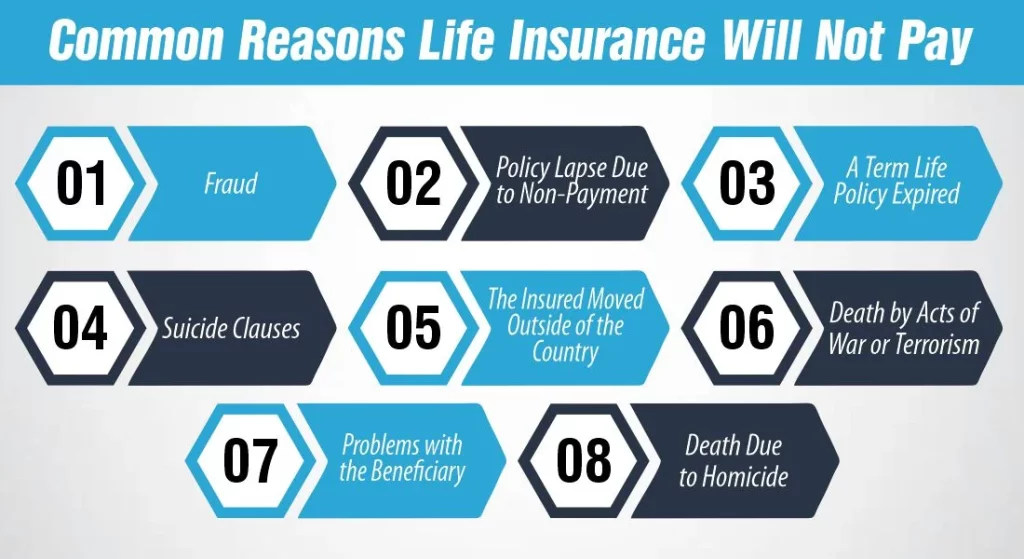

Common Reasons Life Insurance Will Not Pay:

Navigating the intricacies of life insurance is crucial for ensuring your loved ones are financially protected in your absence. However, there are specific scenarios where life insurance claims might be denied, leaving families without the support they anticipated. Understanding these common reasons can help policyholders take proactive steps to secure their coverage.

Fraud

Fraud in life insurance typically involves deliberate deception about one’s health status, lifestyle, or financial situation during the application process. Insurance companies conduct thorough investigations, especially if a claim is made shortly after the policy is issued. This can include reviewing medical records, financial documents, and even social media. To prevent denial on these grounds, it’s vital to be completely honest when applying for coverage.

Policy Lapse Due to Non-Payment

A life insurance policy is a contract that remains in effect only as long as premiums are paid. Missing payments can lead to a policy lapse, and insurers usually offer a grace period to catch up on overdue premiums. However, if this period passes without payment, the policy is canceled, and the insurer is not obligated to pay out upon the insured’s death. Setting up automatic payments or reminders can help avoid unintentional lapses.

A Term Life Policy Expired

Term life insurance offers coverage for a period of 10, 20, or 30 years. It’s designed to provide financial protection during specific times of need, like while raising children or paying off a mortgage. However, if the insured passes away after the term has expired, the policy does not pay out since the coverage is no longer in effect. This situation often surprises beneficiaries, especially if they need to know the policy’s expiration date.

Suicide Clauses

Suicide clauses protect insurers from financial exploitation by individuals who might see life insurance as a way to provide for their families after their death. If suicide occurs within the contestability period, the insurer may refuse to pay the death benefit, although premiums paid may be refunded. Understanding the specifics of this clause is crucial for all policyholders.

The Insured Moved Outside of the Country

Certain policies have geographical restrictions and may not cover deaths outside these areas. This is often due to varying risks and legal regulations in different countries. Policyholders planning to move abroad should consult their insurer to understand their policy’s geographical limits and seek additional coverage if necessary.

Death by Acts of War or Terrorism

Exclusions for deaths resulting from acts of war or terrorism are common in life insurance policies. These events are considered too high-risk to be covered under standard terms. Individuals working in high-risk professions or areas should seek specialized policies that provide the necessary coverage.

Problems with the Beneficiary

Issues with beneficiaries can complicate or delay payouts. For example, if a beneficiary is implicated in the policyholder’s death, they may be legally barred from receiving the benefit. Additionally, disputes among beneficiaries or unclear designations can lead to legal battles. Designating beneficiaries clearly and reviewing them regularly can mitigate these issues.

Death Due to Homicide

In cases of homicide, insurers conduct extensive investigations to rule out any involvement of the beneficiary. This process can delay payouts significantly. Beneficiaries can assist by cooperating fully with the investigation and promptly providing all requested information.

To ensure that life insurance provides financial security for beneficiaries, policyholders must understand these potential pitfalls and manage their policies accordingly. Regular communication with the insurer, understanding the policy’s terms, and maintaining transparency are key steps in securing this vital safety net for loved ones.

What should you do if life insurance will not pay?

When faced with the daunting reality that a life insurance policy will not pay out, knowing the steps you can take to address the situation is crucial. This unfortunate scenario can leave beneficiaries feeling vulnerable and uncertain, but some actions can be taken to navigate these challenging times.

Review the Policy and Denial Reason

Start by carefully reviewing the policy documents and the insurer’s denial letter. Understand the specific reasons for the denial, as this will guide your next steps. Common reasons include policy lapse due to non-payment, exclusions specified in the policy, or issues with the application information.

Contact the Insurance Company

Reach out to the insurance company to discuss the denial. Request a detailed explanation and see if a misunderstanding or error led to the denial. It’s also worthwhile to ask about any potential steps that can be taken to contest the decision.

Gather Supporting Documents

Collect any documents that support your case. This could include medical records, proof of premium payments, or any correspondence related to the policy. The type of documents will depend on the reason for denial.

Consider an Appeal

If, after discussing with the insurance company, you still believe the claim was unjustly denied, look into the appeals process. Each company has a procedure for appealing denied claims. This process typically involves submitting a formal appeal letter along with any supporting documentation.

Seek Legal Advice

If the appeal is unsuccessful and you believe the denial violates the terms of the policy, it might be time to seek legal advice. A lawyer specializing in insurance law can guide you on whether you have a strong case and the best approach. Legal action can be a lengthy and complex process, but it may be necessary to secure the policy’s intended benefits.

Explore Alternative Financial Support

In parallel to contesting the denial, explore alternative means of financial support. This might include other insurance policies the deceased had, government benefits, or support from community organizations. It’s important to ensure financial stability while working to resolve the life insurance issue.

Review Other Policies

The deceased might have had other policies in place, such as accidental death and dismemberment insurance or employer-sponsored life insurance. Check these possibilities, as they offer a separate avenue for claims and financial relief.

Facing the issue of life insurance will not pay is an emotionally and financially taxing situation. However, by taking informed and strategic steps, you can better navigate the process, potentially overturn the denial, and secure the financial protection your loved one intended for you.

Does life insurance cover all types of death?

Life insurance does not cover all types of death; policies typically include specific exclusions. Common exclusions are death due to suicide within the policy’s initial contestability period (usually the first two years), deaths related to criminal activities, and deaths resulting from certain risky behaviors or hobbies.

Additionally, deaths occurring in regions or under circumstances deemed hazardous, such as war zones or due to acts of terrorism, may not be covered. It’s essential to read your policy carefully to understand what is and isn’t included, ensuring you’re fully aware of the coverage scope and any limitations.

Conclusion

Understanding why life insurance will not pay is crucial in ensuring your loved ones are truly protected. By being aware of the pitfalls—such as incomplete disclosures, missed payments, or policy exclusions—you can take proactive steps to secure the financial safety net you intend to provide. In essence, navigating these complexities is not just about having a policy in place but ensuring it stands strong when needed.

Life insurance is more than a policy; it’s a promise to your family. Ensuring this promise holds firm is perhaps the most profound way to show your care, making their journey forward a little easier and more secure.

FAQs

Will Life Insurance Pay for a Funeral?

Yes, life insurance can pay for a funeral, as the death benefit provided to beneficiaries can be used for any purpose, including covering funeral and burial expenses.

What Happens I Am Late Paying My Life Insurance Premium When I Die?

If you are late paying your life insurance premium and pass away, whether your policy pays out depends on the grace period provided by your insurer, typically 30 days. If your death occurs within this grace period, your policy may still pay out, but the overdue premium might be deducted from the death benefit. However, if the grace period has expired and the policy lapsed, your beneficiaries might not receive any payout.

References:

https://fidelitylife.com/life-insurance-basics/life-insurance-101/reasons-life-insurance-wont-pay-out/

https://www.investopedia.com/which-types-of-deaths-are-not-covered-by-life-insurance-5094285

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.