Life insurance is often seen as a financial tool reserved for married couples or those with children. However, being single doesn’t mean you should overlook this important aspect of financial planning. Whether you’re fresh out of college, enjoying a single life, or focusing on your career, life insurance can play a crucial role in securing your financial future.

While the need for life insurance may not be as obvious when you’re single, it can provide valuable protection for your loved ones and help cover outstanding debts and final expenses. Additionally, purchasing a policy while you’re young and healthy can lock in lower premiums and provide long-term financial security.

In this guide, we’ll explore why life insurance is relevant for singles, the types of policies available, and how to determine if it’s the right choice for you. So, if you’ve ever wondered, “Do I need life insurance if I’m single?” keep reading to find out more.

Do You Need Life Insurance If You’re Single?

Absolutely! Single people don’t have to ignore life insurance as long as it is married or dependent individuals that it is associated with. Life insurance provides beneficial financial tools even for singles, too. Here’s why:

Financial Responsibilities Don’t Disappear:

If you’re single, forget about the aforementioned expenses because you still owe student loans. Another financial crisis is your credit card debts. Moreover, when your parents age, you start to care for them. The loss of the main income earner in the family will often lead to increasing liabilities, such as medical bills, funeral costs, and outstanding expenses. In this case, a life insurance policy can help cover these expenses if something happens.

Protecting Co-Signers and Guarantors:

Considering you have secured a loan or even have a co-signer, your death would be to make them liable for the debt. Through life insurance, it is ensured that the beneficiaries do not face financial trouble at the challenging times when they need to be encouraged the most.

Locking in Lower Premiums:

An effective way of ensuring great benefits is buying the policy while you are still young and healthy. As a result, normal rates remain the same for the duration of the policy, with you saving some money in the long run.

Covering End-of-Life Expenses:

The loss of your income is only exacerbated by funeral costs, and medical bills that still have to be paid for, and life insurance helps with that, materializing an easy way these funds are covered, relieving your loved ones from the financial burden.

For this very reason, it is crucial, irrespective of whether they are single, in a relationship, or in between, to take life insurance that will serve as their protection financially.

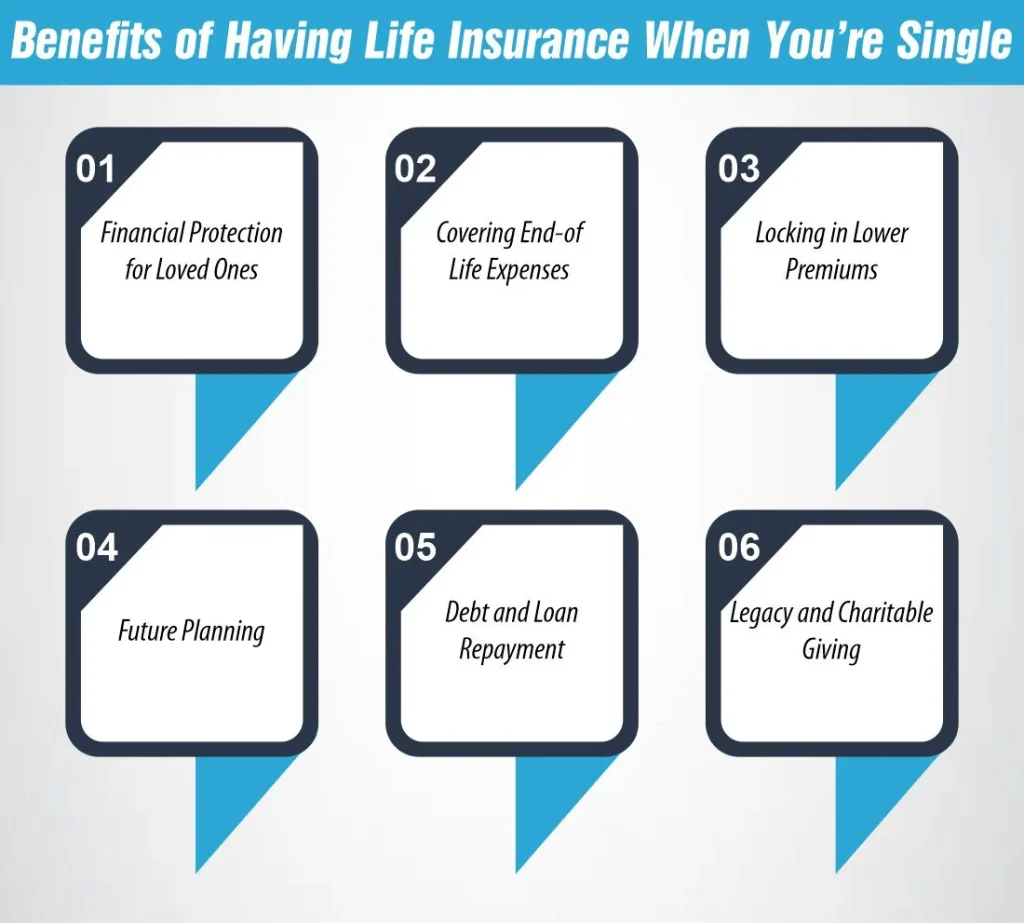

Benefits of Having Life Insurance When You’re Single

Benefits of Having Life Insurance When You’re Single

Having life insurance when you’re single offers several benefits:

Financial Protection for Loved Ones:

Human life insurance prevents your family members from experiencing any financial concern or problems caused by liabilities and obligations like school loans, credit card debt or property payments that could be left unpaid in case of your death.

Covering End-of-Life Expenses:

If you’re in such a situation, you should still think about the expenses that are likely to occur at the end of your life—like funeral costs and medical bills. Life insurance will offer the money to cover those expenses, so it will avoid putting an unnecessary burden on your family’s finances when there is one already, thanks to the nightmare they are already living through.

Locking in Lower Premiums:

The life insurance policies may be bought at the young and active age rate, the lower premiums are promised for the future. You may find that the higher your age, the more expensive your premium will become, thus it is much more beneficial for you in the future if you acquire that early.

Future Planning:

If you expect changes in your life, for example, setting up a family and the idea of owning your own business, the benefits of owning a life insurance policy to have peace will guarantee the foundation of your financial plan and the protection of your insurability in the future.

Debt and Loan Repayment:

In addition to taking care of your family in case of your death. you should assist individuals to whom you have consigned debts or loans to whom it will be a problem to pay the debts. Insurance will then release the financial safety in the case of the death.

Legacy and Charitable Giving:

While life insurance may be one of the most important decisions to make, it can also be an easier way of leaving a legacy or supporting charitable causes you’re deeply involved in, by allowing your generosity to live on even after you die.

On the one hand, life insurance helps to restore peace of mind once again, irrespective of whether you are married or not, and whether you have any dependents or not. It is thus an insurance plan that serves as a precautionary measure towards caring for your loved ones and yourself.

Types of Life Insurance Policies for Singles

It is often a common fact that there are diverse types of life insurance policies. Here’s a breakdown of the most common ones:

1- Term Life Insurance

A version of this policy offers insurance over the next given period, for example, 10, 20, 30 years or more. It is the usual cheapest plan and one can also use it to pay the mortgage in times that it is not housing an individual who is minor but living in their homes until they grow up and become financially independent on their own.

2- Whole Life Insurance

Payout will be made when you die if premiums are maintained continuously. There are two components: cash value and the death benefit that increases the cash value for saving and death benefit at the same time. Although more expensive than the term, it covers a person for the entire life on a fixed basis and guarantees the payment upon the event.

3- Universal Life Insurance

Universal life insurance is a kind of life insurance which is like whole life insurance but allows you to choose the amount of premium and the benefit you will receive if you are dead. It grants you the ability to customize your amount of coverage and change premium repayment once your financial status evolves.

4- Variable Life Insurance

This approach to policy permits an allocation of your monthly premiums to investment accounts, which come in stocks, bonds, or mutual funds. The value and death benefit of the policy are the two variables which reflect these investment performances.

5- Indexed Universal Life Insurance

Indexed universal life insurance allows one to enjoy death benefits and cash value components whose performance is tied to a stock market index which typically populates tables and charts such as the S&P 500. It is not without risk to carry this assumption. However, also having a higher return possibility than with traditional universal life insurance is an advantage.

Life insurance is getting measured by what type of insurance is right for you which will include your financial target, your budget and your risk tolerance. It is important to conduct a careful review of each choice while it also makes everything simple to consult a financial advisor to find out which policy suits you best.

Why Do You Need Life Insurance If You’re Single?

Absolutely, being single doesn’t exempt you from the benefits of life insurance. Here’s why:

Financial Protection: In case of dying, life insurance promises that your friends and family won’t bear any debt if there exist loans like student loans, credit card debts, or mortgages.

Final Expenses: This is not only the case with already mentioned expenses but also can be rendered in the form of funeral fees and medical bills. Through life insurance, you can actually receive money that covers the cost of these necessities keeping your family from being stressed about further financial strain during such a harrowing task.

Locking in Lower Premiums: Such a decision would be of great benefit to you, by letting you get the lowest premiums possible when you’re young and healthy. Mainly, when you grow older, your premiums during each period go up. Hence, taking out an insurance policy early will help you save money eventually.

Future Planning: If you think that your life will be changing anytime soon, let’s say you will be starting a family or you are going to run a business having life insurance coverage in place provides the stability for your financial planning and ensures your insurability altogether.

Basically, life insurance provides peace and a source of financial support whether you are standing in your family life or having any dependency or not. It is a preventive, self-protective measure to stand guard by your loved ones and also your own peace of life.

Conclusion

While life insurance may not be a top priority for single individuals, it can still offer valuable protection and peace of mind. By understanding your financial situation, future plans, and health status, you can make an informed decision about whether life insurance is right for you. Remember, it’s never too early to start planning for the future and protecting your loved ones, even if you’re single.

References:

https://www.progressive.com/answers/life-insurance-for-singles/

https://www.linkedin.com/pulse/do-you-need-life-insurance-youre-single-dont-have-kids-nick-mcgowan

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

Benefits of Having Life Insurance When You’re Single

Benefits of Having Life Insurance When You’re Single